[ad_1]

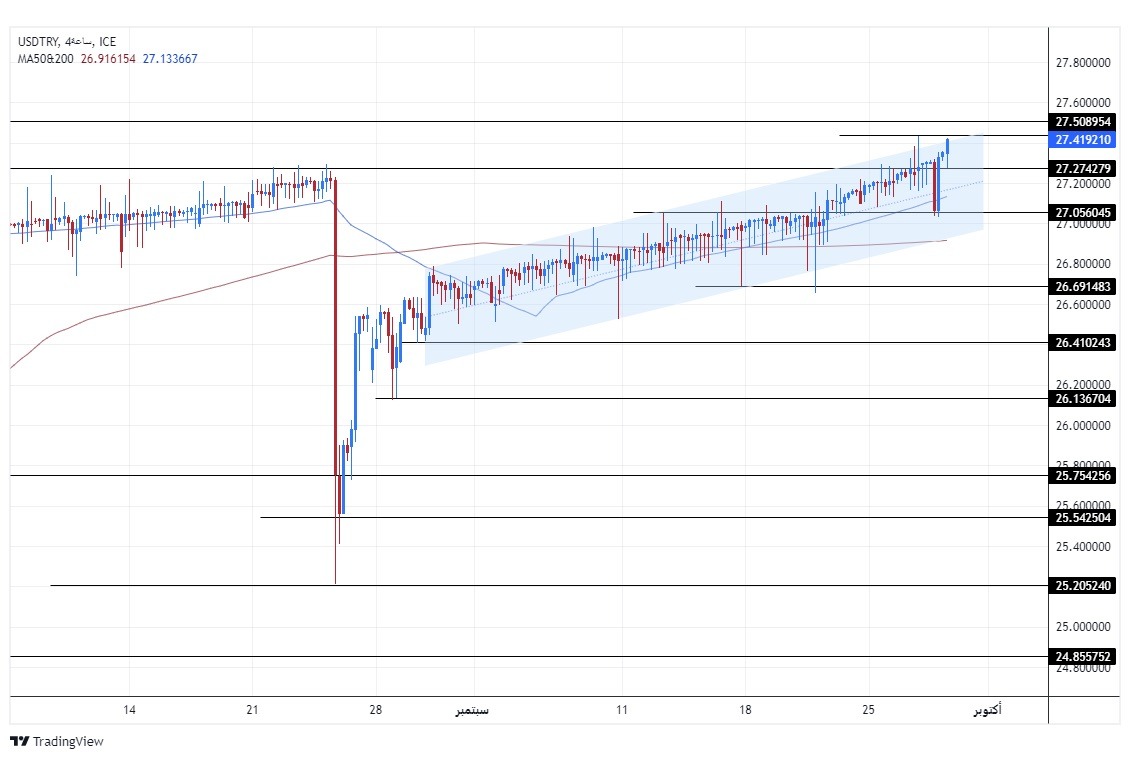

On the technical level, the dollar rose against the Turkish lira at the same slow pace, bringing the pair to its highest level ever, as the pair is currently trading at the upper border of the ascending price channel on the 240-minute time frame shown in the chart.

Forex Brokers We Recommend in Your Region

See full brokers list

Risk 0.50%.

- Entering a buy deal with a pending order from the 27.00 level.

- Place a stop loss closing point below the 26.75 level.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 27.70.

- Entering a sell deal with a pending order from the 27.50 level.

- The best points to place a stop loss are closing the highest level of 27.65.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 26.90.

The price of the Turkish Lira continues to decline against the US dollar during this week’s trading, as the Turkish currency fell to its lowest level against the dollar ever. Regarding the current economic situation in the country, Turkish Minister of Treasury and Finance Mehmet Simsek stressed the importance of patience in the results of the changes taking place in the country’s monetary policy. He also said that the government is working to rebalance the local economy by restricting demand, which is a process that needs some time, stressing that His country is on the right path amid continuing signs of a return to confidence in the economic system that the Turkish government is currently following.

Finally, Simsek commented on inflation in the country, saying that inflation will be in a semi-transitional stage until mid-2024.

Earlier this week, the Turkish President supported the transformation that the country is witnessing with regard to monetary policy, in order to erase any doubt on the part of Western institutions regarding the extent of his patience with those policies, as Erdogan called in his speech: I call on all citizens without discrimination to support the medium-term economic program.

Earlier yesterday, the European Bank for Reconstruction and Development issued a report raising its expectations for economic growth in the country during the current year to reach 3.5% compared to 2.5% in previous expectations, with the Turkish economy recording a growth of 3% during the year. The bank attributed the rise in expectations for 2023 to strong growth during the first half of the year, especially with the large amount of government spending that took place ahead of the local elections.

On the technical level, the dollar rose against the Turkish lira at the same slow pace, bringing the pair to its highest level ever, as the pair is currently trading at the upper border of the ascending price channel on the 240-minute time frame shown in the chart.

Currently, if the pair goes up, it targets the resistance levels concentrated at 27.50 and 27.80, respectively, while if the pair declines, it targets the support levels concentrated at 27.00 and 26.75, respectively. The price is moving above the 50 and 200 moving averages on the daily time frame, as well as on the four-hour and 60-minute time frames, indicating the buyers’ control and the return of the general upward trend recorded by the pair. The pair is expected to record gains as long as it settles within the ascending price channel range. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

[ad_2]