[ad_1]

Opportunities lie in wait as the market retraces, presenting favorable buying opportunities.

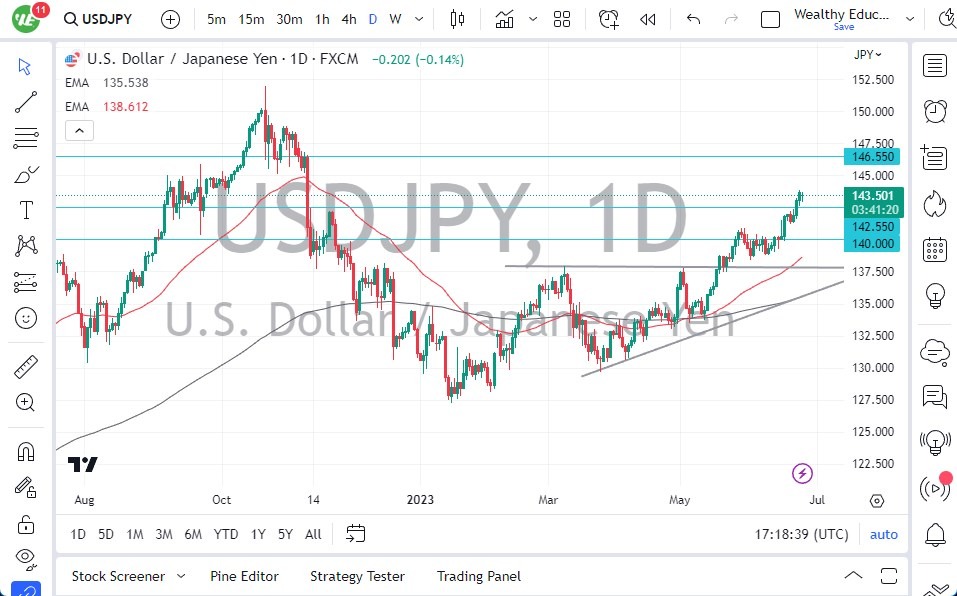

- The USD/JPY experienced a pullback in Monday’s trading session, but the ¥142.50 level could serve as a potential support area. This level had previously acted as resistance, leaving a lasting impression on the market.

- Consequently, it is likely only a matter of time before traders re-enter the market to capitalize on perceived value and the allure of “cheap US dollars.”

- From a technical perspective, the market’s measured move based on the bullish flag pattern suggests further upside potential.

Forex Brokers We Recommend in Your Region

See full brokers list

A significant ascending triangle pattern has also emerged, indicating a measured move that suggests a higher trajectory, potentially targeting the ¥148 level. Furthermore, the bullish flag pattern reinforces the notion of upward movement, with its measured move projecting towards the ¥149 level. These technical indicators provide multiple reasons to anticipate further gains in this market.

Considering the fundamental landscape, the Bank of Japan continues to implement quantitative easing, leading to a substantial interest rate differential between the two economies. This significant disparity supports the notion that this currency pair will continue to appreciate over the long term. Given these circumstances, there is currently no interest in shorting this market unless there is a notable shift in the Federal Reserve’s stance or a major development concerning the Bank of Japan. The US dollar will likely face upward pressure Until such changes occur. Moreover, global growth concerns contribute to the attractiveness of the US dollar as a safe-haven currency.

Opportunities lie in wait as the market retraces, presenting favorable buying opportunities. The Federal Reserve’s tight monetary policy and global growth uncertainties are expected to drive continued upward pressure on the US dollar. Traders should view each dip as a potential buying opportunity, as has happened in recent months.

Ultimately, the US dollar retraced during Monday’s trading session, but the ¥142.50 level holds promise as a potential support zone. The market’s memory of resistance at this level suggests a likelihood of renewed buying interest. The technical analysis reveals further upside potential based on the bullish flag’s measured move and the ascending triangle patterns. The Bank of Japan’s monetary policy, characterized by quantitative easing, creates a significant interest rate differential that favors the US dollar. As a result, shorting this market lacks appeal at present. Dips in the market should be seen as opportunities to accumulate positions, given the Federal Reserve’s tight monetary policy and global growth concerns. Considering these factors, it is reasonable to expect further gains in the US dollar against the yen, with each retracement providing a potential buying opportunity. Traders should remain mindful of potential shifts in central bank policies and global economic developments that may impact the market’s dynamics.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

[ad_2]