[ad_1]

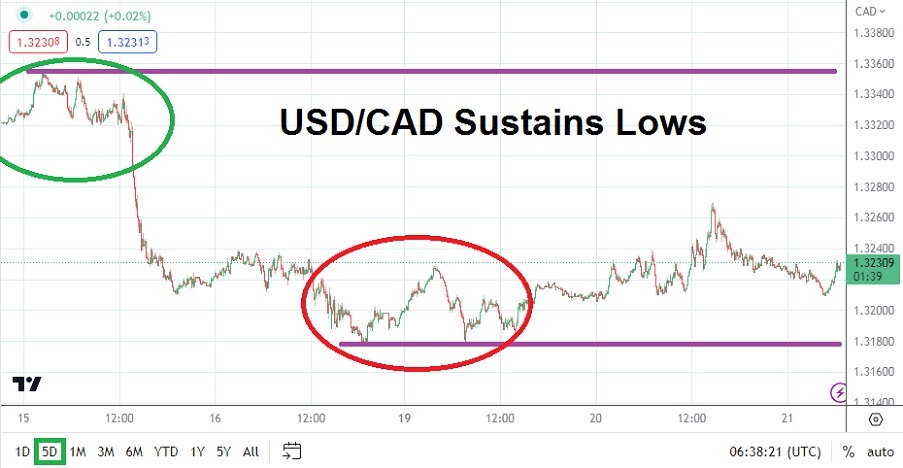

The USD/CAD has been able to hold onto its lower price range with only slight reversals being demonstrated over the short term.

The USD/CAD hit a low of nearly 1.31770 on Friday of last week, this came after highs of nearly 1.33525 were seen on Wednesday of last week. The downward trend of the USD/CAD has been significant since the 31st of May when the currency pair was trading near the 1.36500 level. The past couple of days of trading in the USD/CAD have seen consolidated choppy results, but reversals higher have not been sustained. Yesterday’s high of nearly 1.32720 was beaten downwards.

Forex Brokers We Recommend in Your Region

See full brokers list

The ability of the USD/CAD to maintain its lower values is now causing a major challenge to perceived technical support from the middle of November last year, and values attained this past Friday tested ratios not seen since September of 2022. The question some traders may be contemplating is if the USD/CAD can in fact traverse lower and if price velocity can be fast. However because the U.S. Federal Reserve is still warning about stubborn inflation, the downward trajectory if achieved is likely to remain incremental steps.

U.S. Federal Reserve Chairman Jerome Powell will be speaking today and tomorrow in front of Congress. His testimony before the House and Senate committees will impact the USD/CAD today and tomorrow. Although major surprises are unlikely from Powell’s rhetoric, traders should be braced for more warnings from the Fed Chief that additional interest rate hikes could be seen. However, current trading conditions in the USD/CAD indicate financial institutions do not believe the Fed can remain aggressive for long. The current price of the USD/CAD is near 1.32400

- Traders who remain bearish and want to pursue lower realms in the USD/CAD cannot be blamed, but short-term resistance levels above should be monitored.

- While Jerome Powell is a seasoned speaker and knows that he should not scare the financial markets, if Powell should issue a surprising quote, his remarks could spur volatility.

Quick-hitting trades may prove to be the best tactic for day traders who want to take advantage of the USD/CAD today, but choppy conditions may prevail. Support levels near the 1.32320 to 1.32200 may look tempting for traders to target with wagers looking for additional downside momentum. Speculators should not be overly ambitious today and be prepared for cautious market conditions which produce a test of the current USD/CAD near-term range.

Current Resistance: 1.32475

Current Support: 1.32310

High Target: 1.32575

Low Target: 1.32020

Ready to trade our daily Forex analysis? We’ve made a list of the best forex brokers accepting Canadian clients to trade Forex worth using.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex brokers accepting Canadian clients to trade Forex worth using.

[ad_2]