[ad_1]

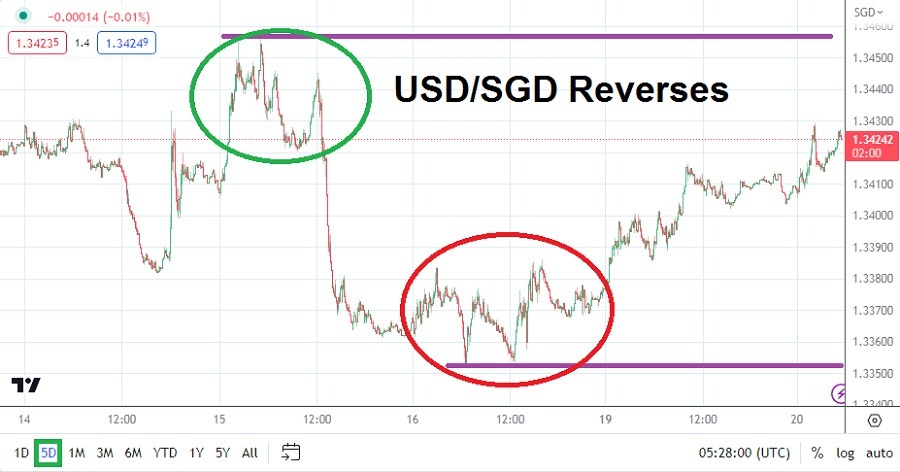

The USD/SGD has reversed higher in early morning trading today, but this buying has developed after one-month lows were produced last Friday.

Speculative bears in the USD/SGD have had to deal with a reversal higher this morning and the currency pair is now trading around the 1.34215 mark. However, this high comes after a solid trend downward which produced incremental selling and produced a one-month low of nearly 1.33525 on Friday. Yesterday’s trading in the SGD/USD saw buying take place too for the currency pair, but before traders assume the trend is going to see a sustained burst higher they might want to consider what has taken place since the last week in May.

Forex Brokers We Recommend in Your Region

See full brokers list

A high of nearly 1.35620 was achieved on the 31st of May; this apex had not been seen since the 10th of March. Since the highs of late May, the USD/SGD has sold off in a rather correlated manner to the broad Forex market. Traders should also consider that U.S financial institutions were on holiday yesterday, which means full volume Forex will only return in the next handful of hours. The lower move of the USD/SGD has been rather productive the past few weeks, this as behavioral sentiment turned slightly more optimistic about their outlooks regarding the U.S Federal Reserve becoming less aggressive.

While the U.S. Federal Reserve did not raise its interest rate last Wednesday as widely anticipated, the U.S central bank is still threatening to hike the Federal Funds Rate in late July. However, on the surface via the results in the broad Forex market, many financial institutions do not seem to believe the Fed will actually increase rates next month. The doubts hovering over what will happen next via the Fed will cause choppy conditions for the USD/SGD.

- FOMC member John Williams is speaking later today, and his rhetoric could impact the USD/SGD. Williams is the Federal Reserve Bank of New York President and his opinions carry weight in the financial markets.

- Fed Chairman Jerome Powell will testify in front of Congress tomorrow and on Thursday. His remarks are sure to cause a reaction in Forex and the USD/SGD.

The trend in the USD/SGD since the start of June does look rather tempting for wagers seeking downside price action. Yet day traders will need to be careful because the USD/SGD is clearly reacting to nervous behavioral sentiment being generated by comments from U.S Federal Reserve officials who seem to rather unclear regarding their own thinking. Thus rather choppy short-term conditions may prevail.

Short-term traders may simply want to pursue quick-hitting bets using solid risk management which gets them out of trades fast. Conservative wagers should be used by day traders without deep pockets, because volatility may persist as the broad financial markets search for a clear outlook.

Current Resistance: 1.34315

Current Support: 1.34090

High Target: 1.34620

Low Target: 1.33770

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.

[ad_2]