[ad_1]

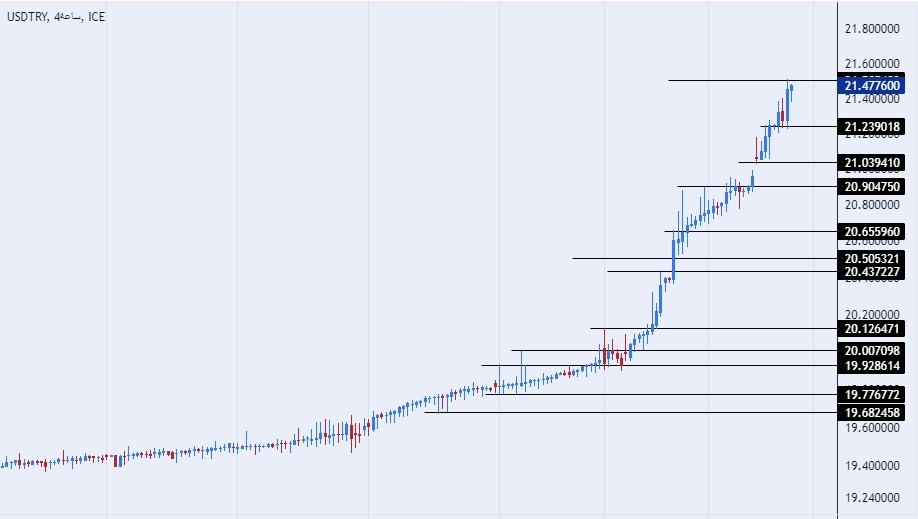

On the technical front, the USD/TRY rose, as the pair maintained a strong bullish general trend that continued for more than a month, with the pair recording new levels on a daily basis.

The risk is 0.50%.

- Entering a buy order pending order from the 21.20 level.

- Place a stop loss point to close below the 21.09 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 21.50.

- Entering a sell order pending order from the 21.50 level.

- The best points to place a stop loss close to the highest level of 21.6.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level of 21.25.

The TRY/USD opened the weekly trading with more losses, as the price opens with daily declines in the price of the Turkish currency against the dollar in light of negative expectations dominating the economy after Turkish President Recep Tayyip Erdogan won the presidency in the country, despite some optimism about the appointment of Mehmet Simsik, Minister of Finance, is a supporter of the traditional theory in economics, which is based on raising interest rates to counter inflation.

On the data front, investors followed the positive data released yesterday, which revealed that inflation in the country fell to its lowest level in about 17 months. According to the monthly report of the country’s Statistical Office (TurkStat), which was released on Monday, Turkey’s annual inflation rate fell for the seventh consecutive month in May to 39.59%, compared to 43.68% recorded in April. The agency’s decision to exclude household gas use from its calculations helped consumer prices reach their lowest level since December 2021.

TurkStat made the change after President Recep Tayyip Erdogan unveiled a generous economic plan ahead of last month’s presidential elections, which he won in a second round. The plan included providing free natural gas to citizens at specific rates (25 cubic meters for free per month until May next year) and increasing the salaries of public sector employees by 45%.

On the technical front, the USD/TRY rose, as the pair maintained a strong bullish general trend that continued for more than a month, with the pair recording new levels on a daily basis. The lira declined during early trading this morning, as the pair reached 21.50 levels. The lira is under great pressure in light of the adopted monetary policy, as it hardly records any significant correction. At the same time, the pair is trading above the support levels, which are concentrated at 21.20 and 21.10, respectively.

The price also settles below the resistance levels that are concentrated at 21.50 and 22.00. The price is moving above the moving averages 50, 100, and 200 on the daily timeframe, as well as on the 4-hour and 60-minute timeframes, in a sign of the strong bullish general trend. Even announcing the expected changes in monetary policy, any fall in the dollar against the lira represents an opportunity to buy back again. Please adhere to the figures in the recommendation, while maintaining capital management.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

[ad_2]