[ad_1]

The AUD/USD has fallen rather hard during the course of the week, slicing through the 0.66 level. That being said, it looks like the market is going to continue to be a “fade the rally” on short-term charts, as we will eventually try to work our way down to the 0.64 level. At this point, if we were to break back above the 0.66 level, it would be a very major victory for the Australian dollar as it looks like markets are starting to run toward safety and of course the United States in general. I remain bearish.

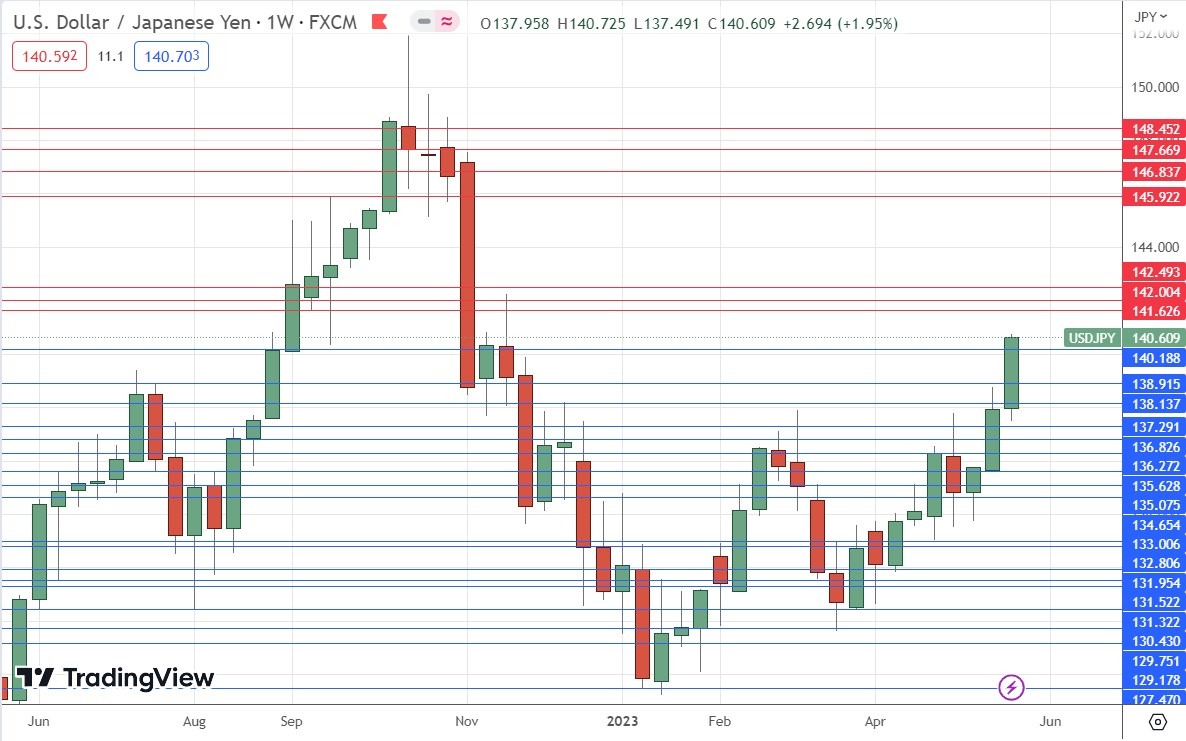

The USD/JPY has exploded upward against the Japanese yen during trading this past week, and now we find the market well above the ¥140 level. At this point, it looks as if we are going to continue to go much higher, and if we can break above the ¥142 level, then it’s likely that we could go looking to the ¥145 level. Short-term pullbacks into being a nice buying opportunity, as the ¥138 level should be a “hard floor in the market”, as it is the top of an ascending triangle that we just broke out of. The Bank of Japan and its monetary policy will continue to put downward pressure on the value of the Japanese yen.

The GBP/USD has fallen hard against the greenback during the trading week as we are now testing the 50-Week EMA. That being said, this is an indicator that does $10 for a little bit of support so we will have to see whether or not we rally. I suspect that the next week or 2 are going to be very noisy in the Forex markets as we try to determine whether or not the global slowdown is going to continue to have money running toward the greenback. The British pound has been a fairly strong performer over the last couple of months, so this might be a dip within a shorter-term uptrend.

The EUR/USD fell during the week to test a major uptrend line. As we are hanging around the 1.07 level, it will be interesting to see whether or not the buyers come back to try to pick up “cheap euros.” If they do, then this could be a nice buying opportunity, but if we break down below the 50-Week EMA, then I believe that the euro will go looking toward the 1.05 level underneath, which was a major swing low as of late. I am bearish but must see this area just below cleared to start shorting again.

The NZD/USD has broken down significantly during the week, as it is plunging toward the 0.60 level. At this point, if we break down below the 0.60 level, then that could open up a floodgate of selling, so I will be paying close attention to that area. If we bounce from here, then I will be looking to fade rallies at the first signs of exhaustion as it will more likely than not send quite a bit of negative pressure into this market.

The USD/CAD has rallied against the Canadian dollar as we continue to see a lot of noisy behavior. Ultimately, this is a market that I think is looking to the 1.3750 level. After that, then we could go looking to the 1.40 level above. Underneath the 1.34 level underneath is where the 50-Week EMA is hanging around and offering support. Ultimately, I think this retains a bit of a “buy on the dip” mentality, but when you look at the bigger chart, you can see that we are still in a range.

The US oil markets have rallied a bit during the trading week but showed quite a bit of exhaustion. With that being the case, I think we’ve got a situation where we continue to see a lot of noise above, with the $80 level being important. If we do fade from there, I would be willing to short. I think in the meantime we are simply going to continue to bounce around and what I would consider to be a “summer range.”

Gold markets have fallen hard during the week but are now testing a major uptrend line. Somewhere around the $1940 level, I would expect to see a little bit of support, but I will need to see momentum to the upside to get long. As far as shorting is concerned, I’m not quite ready to do so yet, but it is starting to look like the $2100 level is still a bridge too far as we have seen multiple times over the years.

[ad_2]