[ad_1]

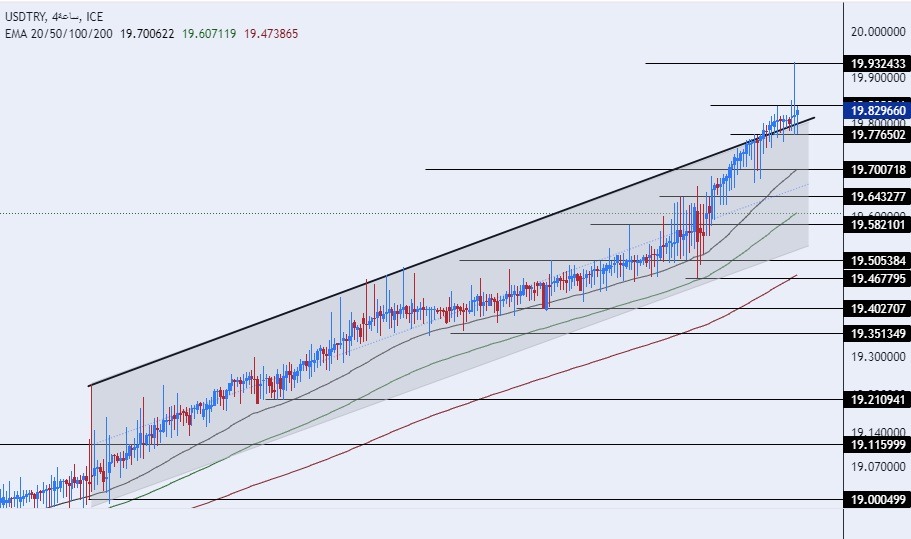

On the technical front, the dollar pair against the Turkish lira maintained its gains, recording new peaks, as it reached new all-time highs, after the pair touched levels of 19.93 liras per dollar this morning.

The risk is 0.50%.

- Entering a buy order pending order from the 19.80 level.

- Place a stop loss point to close below the 19.39 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the remaining contracts until the strong resistance levels at 25.00.

- Entering a sell order pending order from the 20.00 level.

- The best points for placing a stop loss close to the highest level of 20.15.

- Move the stop loss to the entry area and follow the profit when the price move by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 19.75.

The TRY/USD continued its losses against the dollar, as it opened the weekly trading with new declines in the price of the lira against the dollar, recording a new low before the country entered the run-off of the presidential elections. Turkish President Recep Tayyip Erdogan pledged to maintain his unconventional monetary policy if he is re-elected, which is a policy based on lowering interest rates and stimulating the economy with the aim of increasing production and raising exports. Although Erdogan’s policy has not yet borne fruit, as the country recorded record inflation in conjunction with a decline in the value of the lira after Erdogan pressured the central bank to cut interest rates.

The US dollar recorded levels of 20.40 at the local exchange in a tourist destination known as the Grand Bazaar, with expectations expanding that the Turkish currency would record further declines in the post-election period. Citizens’ hedging operations are expanding as demand for gold and dollars increases in the local market for fear of an imminent decline after the elections, especially with the decline in the country’s central bank’s ability to support the lira significantly, especially in light of the decline in the country’s cash reserves of foreign currencies.

On the technical front, the dollar pair against the Turkish lira maintained its gains, recording new peaks, as it reached new all-time highs, after the pair touched levels of 19.93 liras per dollar this morning. The US dollar maintained its gains against the lira, which accelerated during the current election period. Currently, the price broke the upper border of the ascending channel on the four-hour time frame, with the price closing above the upper border of the channel, and the price is trading above the support levels that are concentrated at 19.80 and 19.70, respectively.

At the same time, the price is settling below the resistance levels that are concentrated at 20.00 and 20.50. The price is moving above the moving averages 50, 100, and 200 on the daily timeframe, as well as on the 4-hour and 60-minute timeframes, in a sign of the strong bullish general trend. Because of the expected changes in monetary policy after the elections, any decline in the dollar against the lira represents an opportunity to buy back again. Please adhere to the figures in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.

[ad_2]