[ad_1]

Under prevailing conditions, the market will likely witness more sideways movement, with a potential inclination towards support rather than resistance.

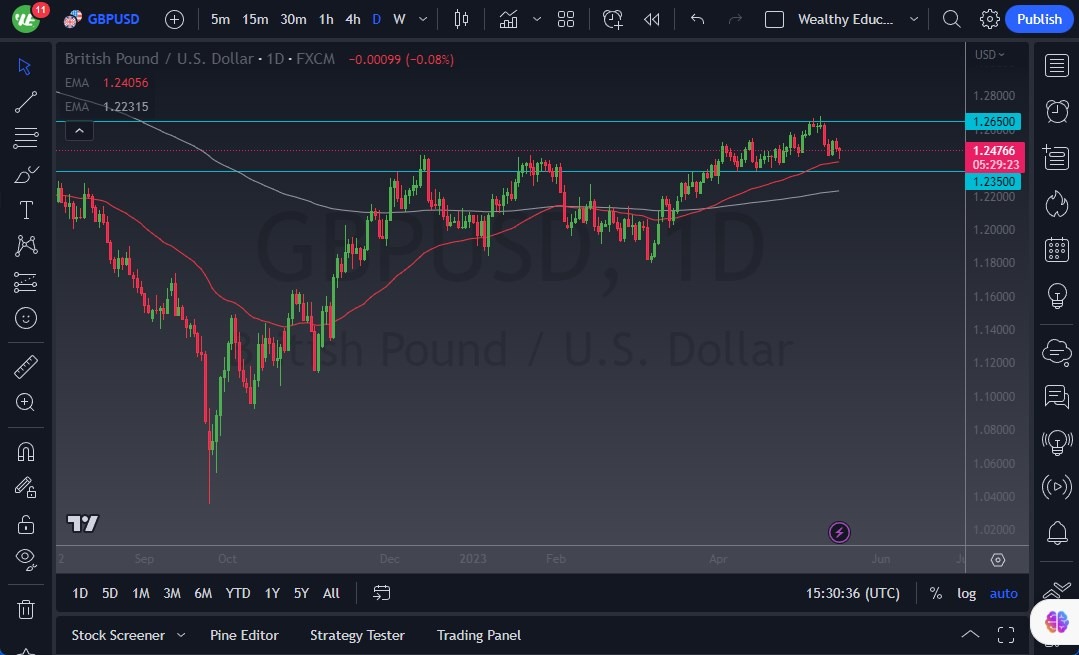

- The GBP/USD initially declined during Wednesday’s trading session, testing the 50-Day Exponential Moving Average (EMA).

- Positioned around the 1.24 level, the 50-Day EMA holds psychological significance as a large, round figure.

- Despite ongoing volatility, this suggests a potential upward movement in the market.

A breach below the 1.2350 level could pave the way for a decline toward the 200-Day EMA, a level closely monitored by many market participants. Around the 1.22 region, increased interest is expected. A further breakdown below this level could signal a shift in trends. It is important to note that the British economy is currently grappling with inflationary pressures, which logically support upward pressure on the pound. However, if the market becomes increasingly concerned about negative factors, it inclines to seek refuge in the US dollar, potentially impacting the British pound as well.

Under prevailing conditions, the market will likely witness more sideways movement, with a potential inclination towards support rather than resistance. However, surpassing the challenging 1.27 level has proven difficult, and when achieved, it could propel the market toward the psychologically and structurally significant 1.30 level. This level is expected to generate considerable noise, capturing attention and making notable headlines.

In this environment, it is crucial to exercise caution in position sizing and recognize that volatility may work against traders over time. Consequently, a cautious approach is necessary. The market continues to face numerous inquiries, yet buyers appear resolute in their stance.

TL;DR: the British pound encountered an initial decline, briefly testing the 50-Day EMA during Wednesday’s trading session. The 1.24 level, marked by the 50-Day EMA, holds psychological significance. Volatility persists, indicating the potential for upward movement. A breach below the 1.2350 level could lead to a decline toward the 200-Day EMA and generate increased interest around the 1.22 region. In the face of inflationary pressures, the pound faces upward pressure, but it remains susceptible to the market’s sentiment and its proclivity to seek refuge in the US dollar. Sideways movement is expected, with potential support outweighing resistance. Overcoming the challenging 1.27 level could trigger a move towards the significant 1.30 level, accompanied by notable market noise. Cautious position sizing and vigilance are crucial due to prevailing volatility. The market confronts numerous uncertainties, but buyers exhibit determination.

Ready to trade our daily Forex analysis? We’ve made this UK forex brokers list for you to check out.

Ready to trade our daily Forex analysis? We’ve made this UK forex brokers list for you to check out.

[ad_2]