[ad_1]

Risk 0.50%.

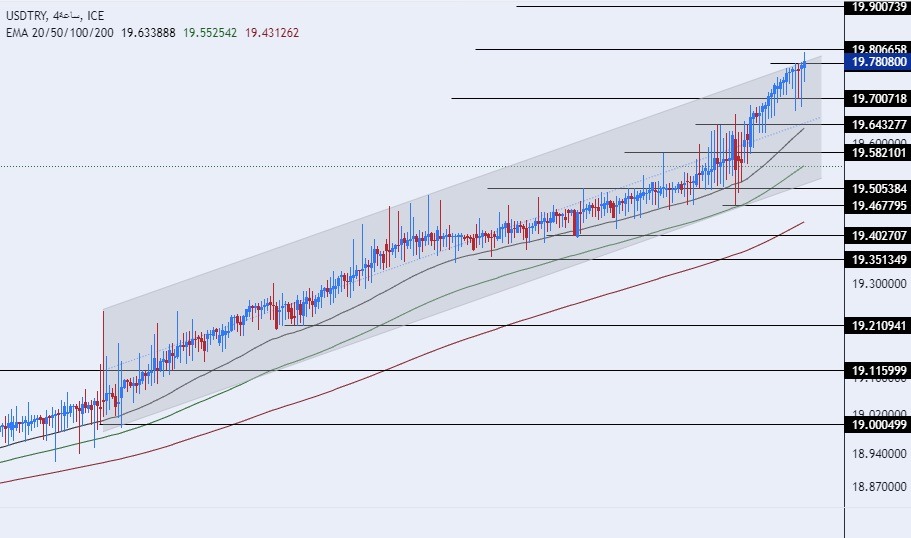

- Entering a buy deal with a pending order from the 19.60 level.

- Place a close stop loss point below the 19.39 level.

- Move the stop loss to the entry area and follow the profit with the price moving by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 20.00.

- Entering a sell deal with a pending order from the 20.00 level.

- The best points for placing a stop loss close at the 20.15 level.

- Move the stop loss to the entry area and follow the profit with the price moving by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level at 19.55.

The TRY/USD continued its losses, as the Turkish currency recorded consecutive losses over the course of this month. With the non-election of the first round and the weighting of Hashem Erdogan for the expected second round during this month, who insisted on sticking to the unconventional monetary policy based on lowering the interest rate despite the country’s high inflation. The state of uncertainty increased, which increased investors’ concern about the Turkish government’s bonds and the ability of the Turkish government to pay them, so that the cost of buying insurance against the risk of non-payment (default swap) increased by 27% to jump to its highest level since November of last year, according to For data from Standard & Poor’s Global Market Intelligent.

As traders of the options contracts at the moment indicated the possibility of the lira declining by two-thirds to reach 26 lire per dollar during the last three months of 2023, the negative expectations come in light of the continuation of the country’s central bank to approve measures and sanctions that would support the lira. The central bank of the country asked the commercial banks to transfer more of the foreign currency in their possession to the lira in the retail accounts, in addition to signing sanctions on the banks that allow their customers to buy gold or withdraw dollars using credit cards, as part of the bank’s steps to put pressure on the growing demand for dollars and the gold.

On the technical level, the dollar pair against the TRY/USD continued to register new highs where it reached its highest new levels ever, after the pair touched levels of 19.79 lira per dollar this morning. The US dollar maintained its gains against the pound, which accelerated its rate of decline compared to the past months and weeks. At the moment, the price is trading within the range of the rising price channel on the four-hour time frame with the price trading at the upper limit of the channel, and the price is trading above the support levels which are concentrated at 19.70 and 19.64 respectively. At the same time, the price stabilizes below the resistance levels which are concentrated at 19.80 and 20.00. The price is moving above the 50, 100, and 200 moving averages on the daily time frame, as well as on the four-hour time frame and the 60-minute time frame, indicating a strong general upward trend. Due to the expected changes in monetary policy after the elections, any drop in the dollar against the lira represents an opportunity to buy again. Please adhere to the numbers in the recommendation with the necessity of maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.

[ad_2]