[ad_1]

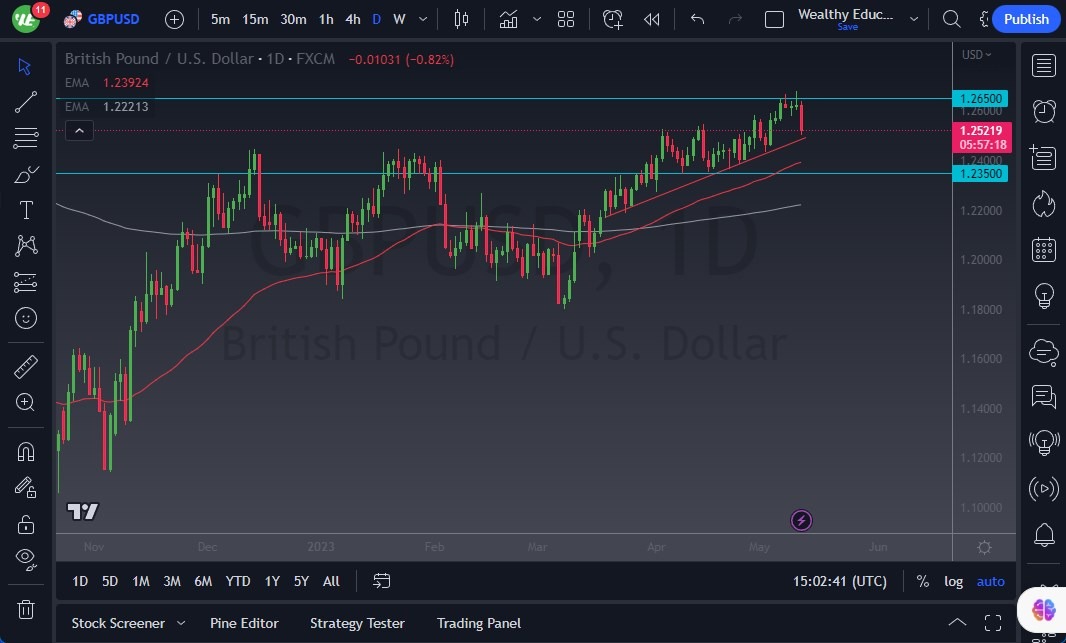

The GBP/USD experienced a minor retreat during Thursday’s trading session but managed to find support just above the 1.2550 level, a significant area that has held importance for an extended period.

- The GBP/USD experienced a minor retreat during Thursday’s trading session but managed to find support just above the 1.2550 level, a significant area that has held importance for an extended period.

- Notably, the Bank of England announced a 25 basis point increase in interest rates during the session.

- However, this move failed to stimulate a bullish response from the market, primarily because it had already been widely anticipated.

A breakdown below the 1.2550 level could potentially trigger some selling pressure. However, the current price action suggests a consolidation phase characterized by alternating hammer and shooting star candlestick patterns. This pattern typically indicates a market that is poised for consolidation. Given this context, it is advisable to exercise caution when taking large positions. Short-term traders may find opportunities to engage in range-bound trading. Nevertheless, it is important to remain nimble and recognize that the market is likely to remain choppy. Position sizing becomes crucial in such an environment, emphasizing the significance of a cautious trading approach.

If the market manages to reverse and break above the 1.27 level, it is probable that the pound will aim for the 1.30 level. It is also advisable to monitor the performance of the British pound against other currencies, as it tends to move in a similar direction following interest rate hikes and statements from the Bank of England. Across the Atlantic, the Federal Reserve is expected to maintain its tight monetary policy stance for an extended period, albeit potentially with a less aggressive rate-hiking approach. The Fed will likely continue its quantitative easing efforts by reducing its balance sheet, leading to increased volatility in the US dollar.

At the end of the day, the British pound encountered a slight retreat during Thursday’s trading session but found support above the 1.2550 level. The Bank of England’s interest rate hike failed to generate a significant market response, given that it was widely expected. The price action suggests a period of consolidation, with caution being a crucial aspect of any trading plan. Short-term traders may find opportunities within the range-bound market but must remain vigilant due to potential choppy conditions. A break above the 1.27 level could lead to further gains, while keeping an eye on the pound’s performance against other currencies is recommended. The US dollar is expected to experience volatility due to the Federal Reserve’s monetary policy stance.

Ready to trade our Forex daily forecast? We’ve shortlisted the best regulated forex brokers UK in the industry for you.

[ad_2]