[ad_1]

Gold is primarily used for wealth preservation, particularly during times of global economic uncertainty.

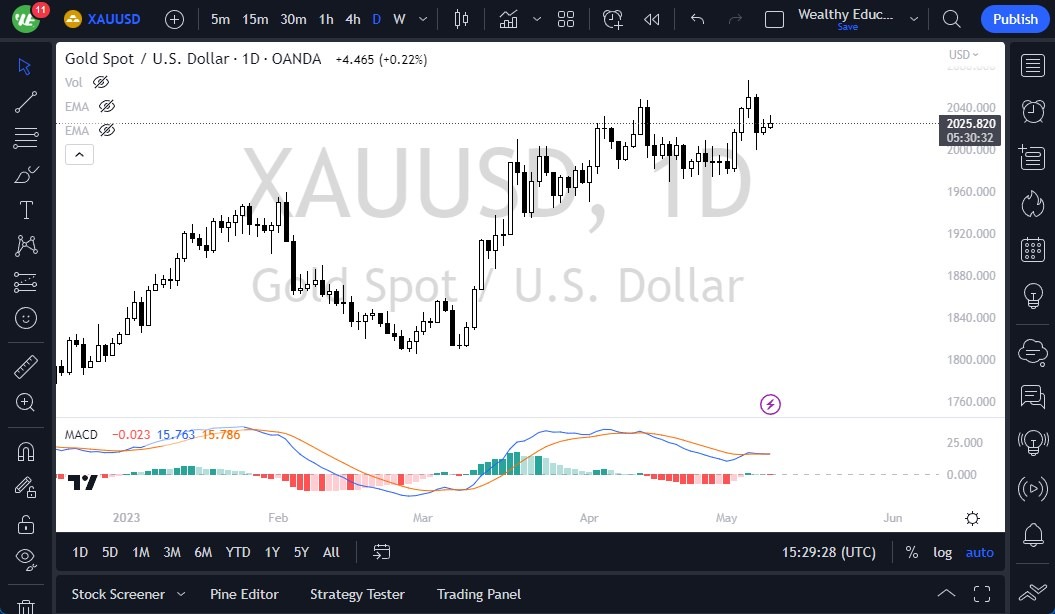

- Gold prices recently experienced stabilization on Tuesday, with buyers capitalizing on dips in the market.

- The $2000 level and the 50-Day EMA near the $1975 level have provided significant support for the market, indicating a potential resurgence soon.

- Gold continues to see a lot of interest, and many traders will be looking to take advantage of the overall economic uncertainty, and the markets will be looking for ways to beat the uncertainty that seems to be everywhere.

Gold is primarily used for wealth preservation, particularly during times of global economic uncertainty. Despite the market’s choppy behavior, buyers will likely return to take advantage of cheap gold prices, with a potential target of $2100 in the long run.

Shorting the gold market is not recommended, given the strong trends and uncertainty in the market. The recent decline in the US dollar will likely cause issues for anyone attempting to short gold. Furthermore, the market’s bullish trend is expected to emerge over time.

If the market breaks below the $1950 level, it could lead to a further drop to the $1900 level, but this scenario is unlikely to happen anytime soon. Buyers are likely to remain in the market until at least the $1950 level.

As investors continue to navigate ongoing economic uncertainty, gold remains an attractive option for wealth preservation. Despite the market’s choppy behavior, gold prices will likely stabilize soon, and buyers will take advantage of the market’s low value. Gold prices have a real shot at breaking to all-time highs, but there will have to be more momentum built up before we get there. Pullbacks should continue to be buying opportunities for those looking to protect themselves from economic conditions. Furthermore, the US dollar will have its part to play as well, so watch if the negative correlation returns.

In conclusion, gold prices recently experienced stabilization, with buyers capitalizing on dips in the market. The $2000 level and the 50-Day EMA have provided significant support, indicating a potential resurgence soon. Shorting the gold market is not recommended due to strong trends and uncertainty, while the bullish trend is expected to emerge over time. Buyers are likely to remain in the market until at least the $1950 level, and gold remains an attractive option for wealth preservation during times of global economic uncertainty.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.

[ad_2]