[ad_1]

All things considered, the market is likely trying to find its summer range, with the $70 level providing significant support and the $86 level serving as resistance.

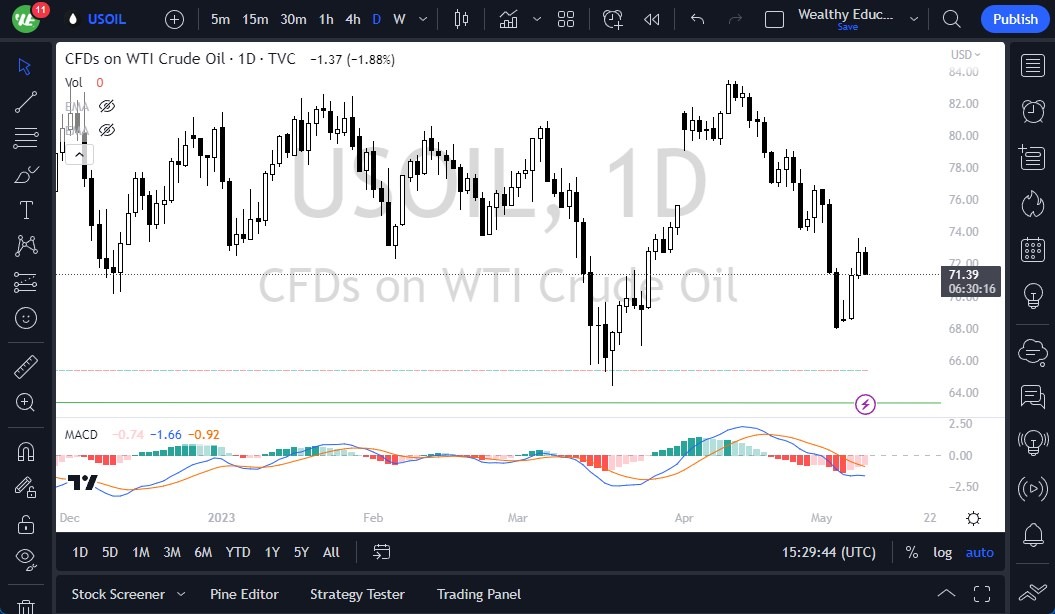

- The West Texas Intermediate Crude Oil market was somewhat soft during Tuesday’s trading session, with the recent bear market rally causing some hesitation.

- While it is possible that the market could move back down to previous levels, significant demand destruction remains a concern due to global economic uncertainty.

- The energy markets directly reflect the state of the global economy, and as it appears to be heading toward a recession, oil prices will continue to struggle.

Oil prices are making great trade opportunities

The 50-Day EMA could pose a potential resistance barrier just below the $76 level, and even if the market breaks above that level, the 200-Day EMA is dropping just above the $80 level. In other words, there is a higher chance of a selloff than an upward trend. However, keep an eye on other markets as well, including the US dollar, as a strengthening greenback could work against the oil markets. Obviously, the exact opposite can also happen.

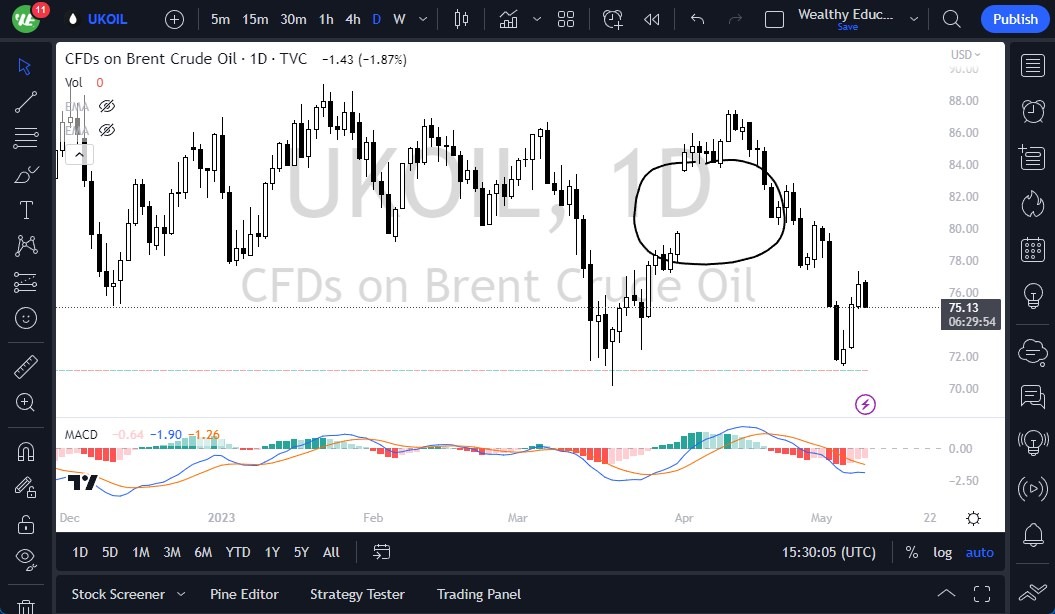

Similarly, Brent markets also saw a recovery attempt but slowed down during Tuesday’s trading session after three extreme sessions. The market is likely to continue experiencing volatility, but the lows could be tested again, given enough time. If the market breaks above the 50-Day EMA, the 200-Day EMA sits around the $86 level.

All things considered, the market is likely trying to find its summer range, with the $70 level providing significant support and the $86 level serving as resistance. The market will continue to exhibit noisy behavior, but it is more likely to move lower than higher. Regardless, if you can be nimble, you may be able to find opportunities in both directions.

In conclusion, the crude oil market is currently experiencing some softness, with concerns about global economic uncertainty causing hesitation. The market is likely to continue exhibiting volatility, with significant demand destruction a major concern. The 50-Day EMA poses a potential resistance barrier, and the 200-Day EMA sits just above the $80 level. The Brent market is also experiencing recovery attempts but is likely to face more volatility, with the lows being tested again in due time. Overall, the market is trying to find its summer range, with the $70 level providing support and the $86 level serving as resistance. The market is likely to move lower than higher soon.

Ready to trade our Forex daily analysis and predictions? Here’s a list of regulated forex brokers to choose from.

Ready to trade our Forex daily analysis and predictions? Here’s a list of regulated forex brokers to choose from.

[ad_2]