[ad_1]

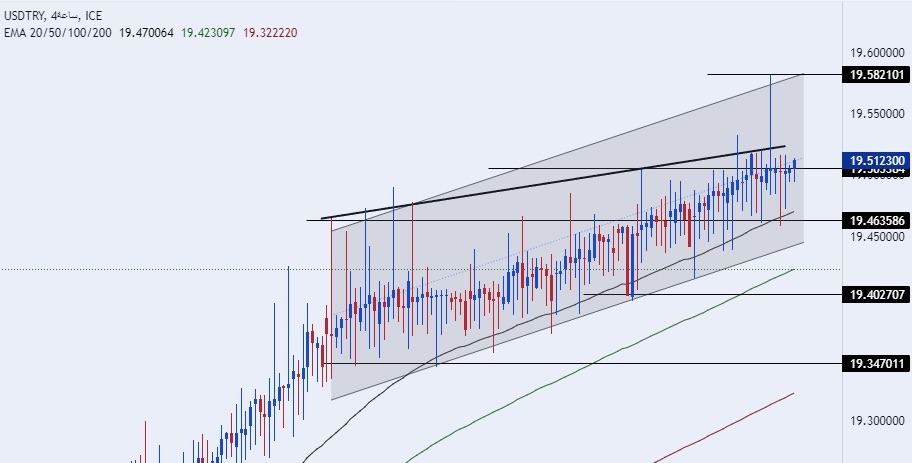

On the technical level, the dollar pair rose against the Turkish lira to record its highest levels ever, as the pair recorded record levels that surpassed the peak recorded earlier this month, where the pair touched levels of 19.58 lira per dollar.

Risk 0.50%.

- Entering a buy deal with a pending order from the 19.30 level.

- Place a close stop loss point below the 18.99 level.

- Move the stop loss to the entry area and follow the profit with the price moving by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance levels at 19.50.

- Entering a sell deal with a pending order from the 19.50 level.

- The best points for placing a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit with the price moving by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the 19.05 support level.

The pair of the USD/TRY recorded a new high to break through the new peak recorded earlier this month. The Turkish lira continues to decline in conjunction with the intensification of the electoral competition between the Turkish president who took power twenty years ago in an election that is the most difficult he faces. The data revealed that the expected volatility index for the price of the Turkish lira reached the highest level around the world, where the implied volatility index for the Turkish lira pair against the US dollar for the next week, which will be reflected in the election results, jumped to 64% yesterday, compared to 8.4% last Friday, to exceed the lira All other currencies, in light of the concerns surrounding the price of the lira in the period following the elections.

It should be noted that several international reports have predicted a strong decline in the Turkish lira in the period following the elections, regardless of the identity of the winning party. At the same time, the reports suggested a change in monetary policy in Turkey, where the interest rate is expected to be raised close to 40% before being reduced to 22% levels near the end of this year, which are expectations that were denied by the Turkish Minister of Finance Nuruddin Nabaty at the time earlier than this month.

On the technical level, the dollar pair rose against the Turkish lira to record its highest levels ever, as the pair recorded record levels that surpassed the peak recorded earlier this month, where the pair touched levels of 19.58 lira per dollar. The dollar maintained its increasing gains against the lira which is declining at a slow pace. At the moment, the price is trading within the range of the rising price channel on the four-hour time frame, the closing price could not be higher than it, and the pair is trading above the support levels which are concentrated at 19.40 and 19.34 respectively.

The price also stabilizes below the resistance levels of the correct number 19.58 and the levels of 20.00. The price is moving above the 50, 100, and 200 moving averages on the daily time frame, as well as on the four-hour time frame and the 60-minute time frame, indicating a strong general upward trend. Due to the difference in monetary policy and the economic situation for Turkey and the expected changes in monetary policy after the elections, any drop in the dollar against the lira represents an opportunity to buy again. Please adhere to the numbers in the recommendation while maintaining capital management.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

[ad_2]