[ad_1]

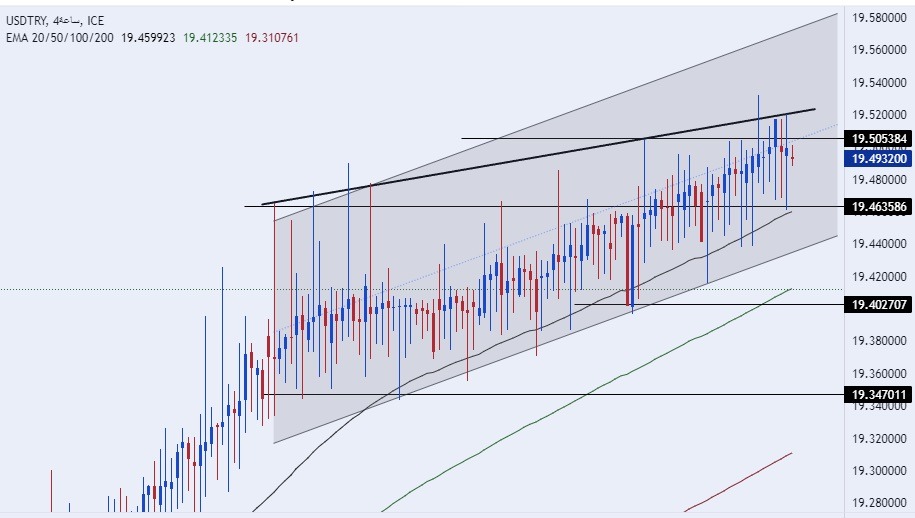

On the technical level, the dollar pair against the Turkish lira stabilized with almost no changes, as it traded close to the highest record levels it recorded during the current month, in which the pair exceeded levels of 19.50 lira per dollar.

Risk 0.50%.

- Entering a buy deal with a pending order from the 19.30 level.

- Place a close stop loss point below the 18.99 level.

- Move the stop loss to the entry area and follow the profit with the price moving by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 19.50.

- Entering a sell deal with a pending order from the 19.50 level.

- The best points for placing a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit with the price moving by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level at 19.05.

The USD/TRY registered slight changes near its highest levels ever during the opening trades of the week. Investors await the results of the presidential and parliamentary elections in the country scheduled for the 14th of this month while voting for citizens residing outside the country has already begun. The exchange rate of the lira is not expected to record significant movements during the current period with the Turkish Central Bank’s keenness in cooperation with the governing institutions to bring some kind of stability to the price of the lira until the upcoming elections pass, which observers describe as the most difficult elections the Turkish president has faced since taking power about twenty years ago. At the same time, the positive promises from each side of the electoral equation continued in the hope of attracting the largest number of voters.

The Turkish Minister of Finance had made statements earlier last week, in which he ruled out a shift from the current financial and monetary policy contrary to what some international institutions decided that expected the country’s interest rate to be raised regardless of the identity of the winning party, reports indicated the possibility of The interest rate reached 49% before falling to around 23% by the end of the year. The forecasts also recorded the possibility of registering a greater decline in the value of the lira immediately after the elections before it stabilizes by the end of the year.

On the technical level, the dollar pair against the Turkish lira stabilized with almost no changes, as it traded close to the highest record levels it recorded during the current month, in which the pair exceeded levels of 19.50 lira per dollar. The dollar recorded a rise against the lira which is declining at a slow pace despite the continuous support from the Turkish Central Bank. At the moment, the price is trading within the range of the rising price channel on the four-hour time frame, and the pair is trading above the support levels of 19.40 and 19.34, respectively.

The price also stabilizes below the resistance levels of the correct number 19.50 and the levels of the correct number 20.00. The price is moving above the 50, 100, and 200 moving averages on the daily time frame, as well as on the four-hour time frame and the 60-minute time frame, indicating a strong general upward trend. Due to the difference in monetary policy and the economic situation in Turkey, any drop in the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation while maintaining capital management.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.

[ad_2]