[ad_1]

The EUR/USD has gone back and forth during the course of the trading, as we continue to see a lot of noise in the Forex markets. It’s worth noting that the Euro is now testing the 200-Week EMA, an area that typically attracts a lot of attention. With that being the case, and the fact that we have just gone through the Federal Reserve, the European Central Bank, and the employment announcements, I think this shows just how choppy this market is going to remain. Ultimately, I think this is a short-term range-bound type of situation.

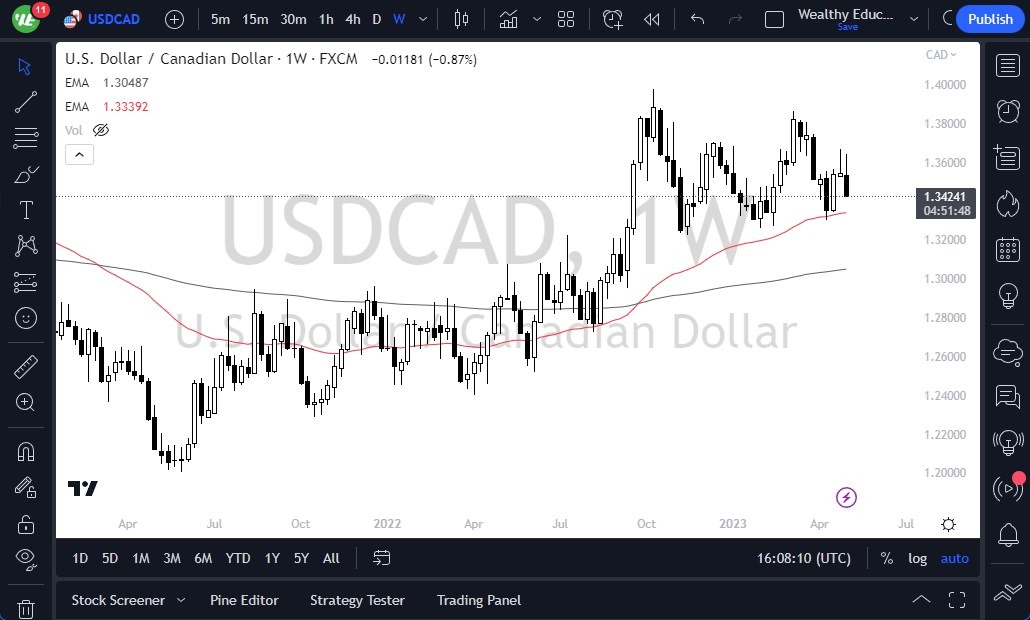

The USD/CAD initially tried to rally against the Canadian dollar this past week, but as oil recovered, so did the Canadian dollar. At this point, it looks like the market is probably going to do what it can to get down to the 1.33 area, perhaps even down to the 1.3250 level. That’s an area that’s been supported multiple times in the past, and therefore I think it will put up a bit of a fight. If we were to break down below the 1.32 region, that could open up and move down to the 1.30 level. Make sure to pay attention to crude oil if you are trading this currency pair.

Gold markets printed a rather ugly candlestick for the week, but it should be noted that a majority of the selling pressure was just on Friday, and we have already seen buyers come back into the market to pick things up top. Because of this, I do anticipate the gold will probably have a fairly decent week, but I don’t know that we are ready to break out above the highs yet. Expect more consolidation, but that does make a certain amount of sense considering that there’s a lot of uncertainty out there, not the least of which would be the regional banks in the United States and whatever is happening over there.

The West Texas Intermediate Crude Oil market, or the US Oil market, had a massive selloff during the middle of the week, but has since recovered quite drastically. At this point, I don’t necessarily think that it’s a signal to start buying, rather it is a signal that the area around the $65 level will probably be the floor in the market this summer. On the upper reaches, I would expect the $80 level to be your ceiling. We are currently in the middle of this market, so I suspect the best way to trade this commodity is to wait for us to get to one extreme or the other and play the support or resistance as it appears.

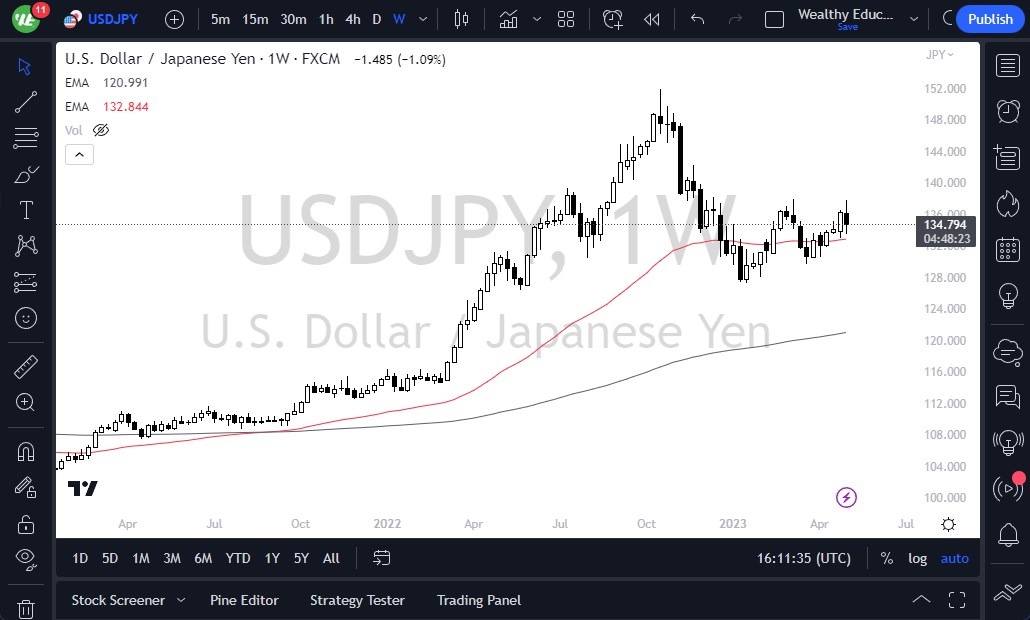

The USD/JPY has had a rather lackluster week against the Japanese yen, but it is continuing to show wherewithal. If you look at the weekly chart, you can see that we are in the midst of an ascending triangle, and I think this will continue to be a market that buyers come in and try to support. If we can break above the ¥138 level, the US dollar can really start to take off against the yen. Keep in mind that the Bank of Japan continues its yield curve control policy, and with interest rates staying high, that does help the US dollar against the Japanese yen.

The EUR/CHF fell during the course of the week to show signs of weakness, reaching the 0.97 level. However, we have turned around to show signs of support again by forming a hammer. This does suggest that perhaps the market is trying to find a range to trade in, which makes sense as that’s typically how this pair behaves. The 0.97 level could be your floor, while I believe parity might be the target above. Keep in mind this pair can move at a snail’s pace, the patients will be needed if you are a buyer.

The British pound continues to hammer resistance, and it looks as if it is probably only a matter of time before it breaks out. If the market breaks above the 1.2650 level for a daily close, it could very well open up the possibility of a move to the 1.30 level. At this point, I think it’s difficult to short this market as the British continued to deal with inflation, leading the central bank to be stuck with a very tight monetary policy. That being said, I think this comes down to the Federal Reserve basically nearing the end of its tightening cycle.

The NASDAQ 100 initially pulled back during the week but has found buyers underneath to support it yet again. This was helped drastically on Friday as Thursday night featured an Apple earnings call that went particularly well. Because of this, it’s very likely that the NASDAQ 100 will try to break out to the upside, and clearing the high of the past 2 weeks could open up a move to the 13,700 regions. This remains a “buy on the dips” type of market as stocks in America simply won’t stay down.

[ad_2]