[ad_1]

The USD/INR has finished the month near bearish values after rather volatile trading shadowed the currency pair as it fought lower and May is set to begin.

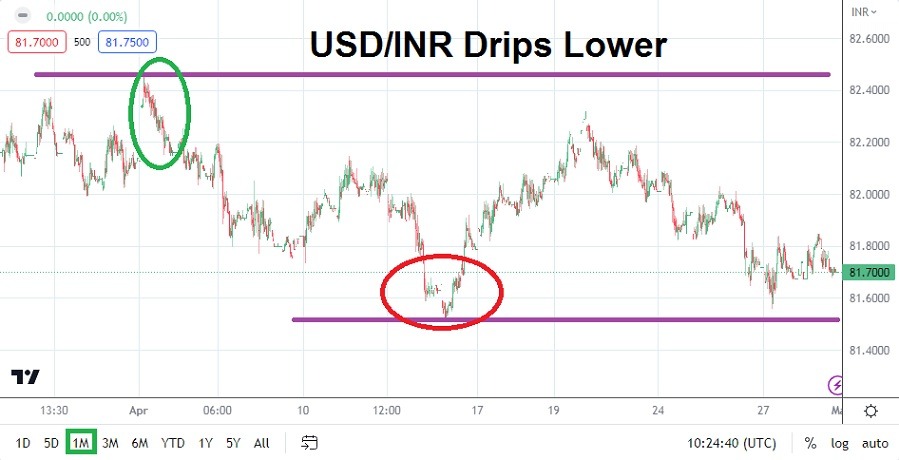

The USD/INR will begin the month of May near the 81.7000 level when trading starts this week. The currency pair essentially began the month near its highs when April started, and began a long incremental fight lower filled with volatile price action as market behavior remained rather nervous. As of this past Monday on the 24th of April the USD/INR was still above the 82.0000 level, and only a couple of trading days before the Forex pair was around the 82.3300 ratio on Thursday the 20th.

A slight fight lower began early this past week, and on Wednesday the USD/INR was still standing slightly above the 82.0000 mark with a rather choppy battle near the key psychological level. CB Consumer Confidence numbers from the U.S came in slightly less than expected on Tuesday, but markets remained nervous because of the important data ahead.

This Thursday the 27th of April proved significant when the Advance Gross Domestic Product number stumbled more than expected. A gain of 2.0% was anticipated for the U.S growth statistic, but a figure of only 1.1% was the result for the GDP data. This began to cause immediate headwinds for the USD in Forex and the USD/INR fell to a low of nearly 81.5550. The U.S economy is showing signs of slowing.

However, as financial institutions were embracing weaker than expected growth numbers from the U.S, inflation results from the States this past Friday came in stronger than expected via Personal Income results. To top it off Personal Spending numbers from the U.S came in slightly higher than expected. This combination of stubborn inflation data created some support for the USD/INR apparently in Forex and the currency pair ebbed slightly higher before going into the weekend near 81.7000.

- Technical and fundamental traders need to acknowledge the U.S Federal Reserve will release its FOMC Statement on the 3rd of May.

- The weaker growth numbers from the U.S may set the stage for a potentially final flurry of aggressive hikes from the U.S Fed this coming week and maybe one more 0.25% in June.

- This because if GDP numbers continue to weaken, the Fed will be hard pressed to remain hawkish past June.

- There are no guarantees, but this past week’s trading in the USD/INR likely reflected sentiment the Fed will have to ease up relatively soon. The question is when exactly.

The U.S Fed has made it clear they want to beat inflation, and income and spending numbers remain stubborn. The U.S central bank is likely to hike interest rates again the middle of this week and leave the door open for another slight increase in June. It doesn’t mean they have the right approach, but financial institutions will have to deal with a higher Federal Funds Rate most likely after the middle of this week. Growth may be slowing, but the Fed may want to ‘hit’ inflation still.

However, any words that a less aggressive stance could develop in the coming months might be enough to help the USD/INR track lower. Having reached a high early in April and having watched an incrementally tough road lower, with most of the bearish price action taking place the past week and a half, speculators should remain cautious in the USD/INR. The question is how much of the coming interest rate hike is still baked into the value of the USD/INR?

The rupee has been extremely popular lately – don’t miss these interesting opportunities!

Trade Now

Speculative price range for USD/INR is 81.1050 to 82.4600

If the USD/INR can sustain prices below the 81.8000 ratio early this week that would be rather surprising and show market forces are positioning for a lower USD/INR. But traders should be ready for some rather choppy price action early this week and into Wednesday with a test of a broad USD/INR range.

Traders will want to hear what the U.S Fed says on Wednesday. Also, please note the U.S will release Non-Farm Employment Change numbers this coming Friday and the result could set the tone for the week beyond. Data is going to help move the USD/INR price range.

While bearish behavior certainly has been seen and price targets lower certainly exists, the rhetoric from the Fed this week will stir the USD/INR. If the currency pair can break below the 81.6000 ratio and challenge the 821.5000 mark, some traders may have their eyes on depths seen toward the end of January.

The danger of a move higher still exists in the USD/INR and if the currency pair breaks above the 82.0000 level because a surprisingly aggressive sounding U.S Federal Reserve, traders could target the 82.1000 price ratio. However, resistance above this mark appears to be rather durable and it seems hard to imagine the USD/INR could challenge highs from the past few weeks unless there are unexpected data results from the U.S or a risk event triggers safe haven buying of the Forex pair.

Ready to trade our Forex forecast for the coming month? We’ve shortlisted the best Forex trading brokers in the industry for you.

Ready to trade our Forex forecast for the coming month? We’ve shortlisted the best Forex trading brokers in the industry for you.

[ad_2]