[ad_1]

The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. There are several valid long-term trends in the market right now, which might be exploited profitably. Read on to get my weekly analysis below.

I wrote in my previous piece on 23rd April that the best trade opportunities for the week were likely to be:

- Long of the EUR/USD currency pair following a bullish reversal on the H4 time frame rejecting $1.0929. The price never reached that support level during the past week, so this did not set up.

- Long of the NASDAQ 100 Index. The Index closed 2.05% higher over the week.

- Long of the GBP/USD currency pair following a daily close above $1.2500. This did not happen until the end of the week.

- Short of the USD/CHF currency pair following a daily close below $0.8840. This did not set up.

My forecast produced an overall win of 2.05%, averaging a gain of 0.51%.

News about global financial markets is currently a bit thin, with only a few important data releases happening last week. However, the coming week is likely to produce some events of powerful impact, notably the US Federal Reserve’s next meeting amid expectation the Fed will make its final rate hike of 0.25% in the current cycle, and the release of non-farm payrolls data in the US at the end of the week.

The most important data released last week were:

- US Core PCE Price Index data showed a month-on-month increase of 0.3%, which was as expected, so this had no impact on inflation expectations.

- US Advance GDP data was disappointing, with annualized growth of 2.0% expected but the data showed growth of only 1.1% which perhaps weakens the case for a further rate hike.

- German Preliminary CPI came in lower than expected, at a month-on-month increase of only 0.4% when 0.6% was expected, which maybe weakens the case for the next Eurozone rate hike.

- Bank of Japan Outlook Report and Monetary Policy Statement – the bank maintained its negative interest rate and dropped part of its forward guidance but made no real major changes.

Last week’s other key data releases were:

- Australian CPI (inflation) data – the quarterly increase was very slightly higher than had been expected, but the headline annualized rate fell from 6.8% to 6.3%, beating the 6.5% which had been widely expected.

- US CB Consumer Confidence data – this came in slightly worse than had been expected, which could be taken as further evidence that the US economy is slowing down.

- Canadian GDP data came in very slightly worse than expected, with month-on-month growth at only 0.1%.

- US Unemployment Claims data

- US Employment Cost Index

The coming week in the markets is likely to see a higher level of volatility thank last week, due to the highly important meeting of the US Federal Reserve scheduled, as well as US non-farm payrolls data. week’s key data releases are, in order of importance:

- US Federal Funds Rate and FOMC Statement

- ECB Main Refinancing Rate and Monetary Policy Statement

- US Non-Farm Employment Change

- RBA Cash Rate and Rate Statement

- Swiss CPI (inflation)

- US JOLTS Job Openings

- US Unemployment Rate

- US ISM Manufacturing PMI data

- New Zealand Unemployment Rate

- US Unemployment Claims

- Canadian Unemployment Rate

Monday will be a public holiday China, Switzerland, the UK, Germany, Italy, and France. Wednesday to Friday inclusive are public holidays in Japan.

The weekly price chart below shows the U.S. Dollar Index was practically unchanged over the past week, with the week’s volatility the second lowest seen since the last week of January earlier this year.

The weekly candlestick is a doji. This often signifies trend reversal. We see a dominant bearish trend, but for three weeks now, the price has been reluctant to fall.

This suggests that the US Dollar is likely to be unpredictable over the coming week, despite the valid long-term bearish trend in which the Dollar is trading below its levels of both 3 and 6 months ago.

We saw a firm rise in the NASDAQ 100 Index over the past week. The picture here is very bullish, for several reasons:

- We see the weekly candle which has just closed is an outside, engulfing candlestick.

- The weekly candlestick closed right on its high.

- The lower wick of the weekly candlestick decisively rejected the support level which I had identified at 12861.6.

- The weekly candlestick made its highest weekly close since August 2022, showing we have a bullish breakout situation, as well as a valid long-term bullish trend.

There are no key resistance levels until 13735, so the price has room to rise.

The NASDAQ 100 Index still looks like a buy.

The EUR/USD currency pair printed something close to a bearish pin bar to end the week slightly higher.

The technical picture is a bit mixed. The bullish factors are the valid long-term bullish trend, and the weekly closing price coming in at a 10-month high, also above the big round number at $1.1000. It is also a fact that this currency pair likes to make deep retracements within trends.

However, the bullish case is a bit weakened by the strong resistance below $1.1100, which seems to be holding strong. Bears can also argue that the last three weekly candlesticks are very close to having printed a bearish pin bar / inside bar combo.

Much will likely depend upon the ECB’s rate decision due this week, as well as whether the bearish trend in the US Dollar continues.

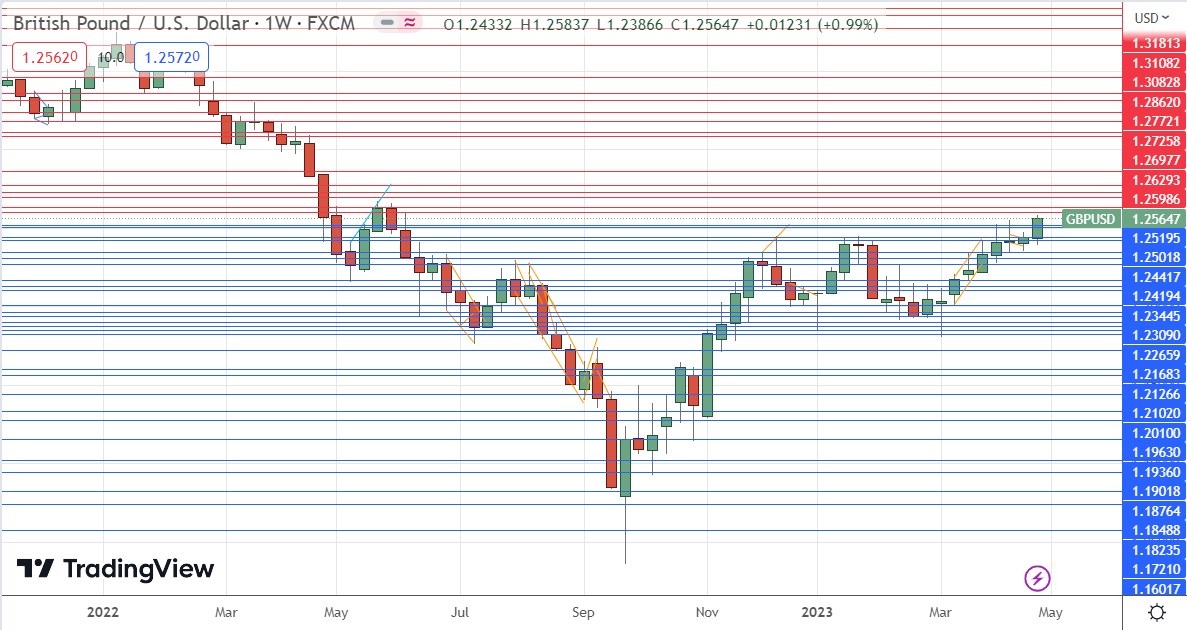

The GBP/USD currency pair rose to make its eights consecutive higher weekly close at a 10-month high.

Additional bullish factors are the price ending the week right on the high of the weekly price range, and the fact that the British Pound was one of the strongest major currencies over the past week.

The British Pound is standing out as a reliably trending currency, although there are questions over how whether the US Dollar is technically ready to fall further.

Much will likely depend this week on what the US Federal Reserve does and says, Markets are expecting a 25bps rate hike. If this is passed, we can expect the price here to rise strongly.

The EUR/JPY currency cross rose strongly last week to break to its highest price recorded in almost 15 years. This is a very bullish sign. We have the Euro in a long-term bullish trend, and the Japanese Yen is weak as the Bank of Japan maintains its negative interest rate and ultra-loose monetary policy.

Although this looks very tempting for a long trade, it might be safer to wait for the EUR/USD to look more bullish technically before entering, and to keep an eye whether the USD/JPY currency pair can break to new long-term highs at the same time.

In the meantime, it might be safer trading EUR/USD long at pullbacks, to exploit the bullish trend in the Euro.

The Sugar ETF CANE has seen a more than 40% price rise since the start of 2023. It made a very strong rise last week, continuing its eye-watering bullish momentum since it broke above the big round number at $10.

It is always difficult to forecast where such strong trends might reverse, but bulls should be aware the price has gone up by a lot and the trend could be seen to be very over-extended. I would therefore prefer to wait for a consolidation and subsequent bullish breakout before entering a new long trade here.

There may be likely resistance levels at $14.25 and at $15.00.

It has historically been very worthwhile trading new 6-month high breakouts in commodities, using a volatility-based trailing stop.

I see the best trading opportunities this week as:

- Long of the EUR/USD currency pair following a bullish reversal on the H4 time frame rejecting $1.0920.

- Long of the NASDAQ 100 Index.

- Long of the GBP/USD currency pair.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.

[ad_2]