[ad_1]

Demand for foreign currencies is increasing amid expectations that the lira will decline in the post-election period.

The risk is 0.50%.

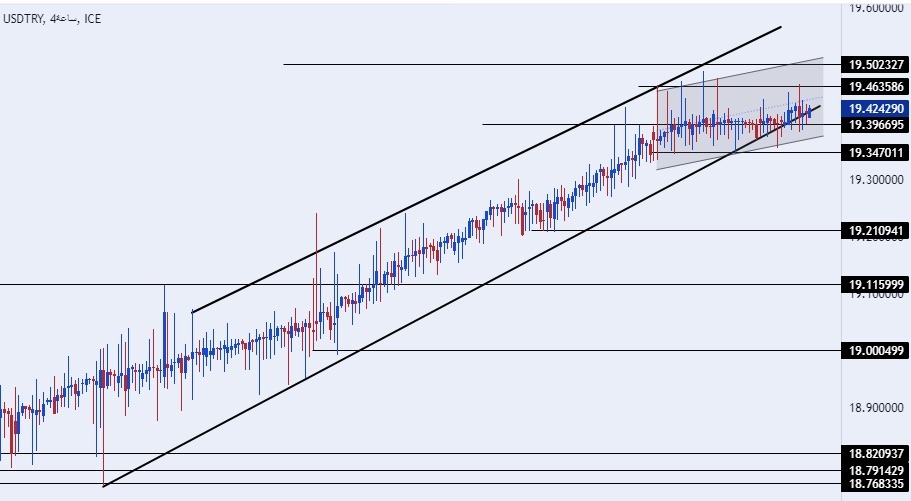

- Entering a buy order pending order from the 19.20 level,

- Place a stop loss point to close below the 18.99 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the strong resistance level at 19.50.

- Entering a sell order pending order from the 19.50 level.

- he best points to place a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the support level at 19.05.

The price of the TRY/USD has stabilized, near its lowest level ever, during early trading on Wednesday morning. Investors followed reports about the monetary tightening policy in the United States approaching its climax with the return of banking sector turmoil, which may put pressure on the US dollar, and reduce its strength against emerging market currencies that have suffered for almost a full year from the strength of the US dollar.

On the other hand, the suffering of the Turkish lira continues in light of the increased demand for foreign exchange in exchange for successive measures from the Turkish Central Bank, which seeks to reduce the demand for the dollar with the decline in the volume of foreign currency reserves in the bank. Demand for foreign currencies is increasing amid expectations that the lira will decline in the post-election period. It is noteworthy that many of the reports mentioned the reasons for the expectations of the lira’s decline away from the identity of the winning party in the elections, amid expectations of raising interest rates to levels of 40% before reducing them to levels of 22% by the end of the year. The expected Turkish elections in the middle of next month represent an important milestone in the future of the country’s monetary and financial policy, especially amid expectations that the Turkish president will turn away from the unconventional monetary policy he has been following for several years.

On the technical level, the dollar pair stabilized against the Turkish lira without changes, near its lowest level ever, which it recorded during the current week, at 19.46 lira per dollar. At the present time, the pair is trading at the lower boundary of the bullish price channel on the time frame of the day, and the pair is also trading inside a smaller price channel on the four-hour time frame, as the dollar continues to record gains against the pound, which takes place with the pair’s rise at a slow pace, the pair is trading higher than support levels are 19.30 and 19.20, respectively.

On the other hand, the price is settling below the psychological resistance levels at 19.50 and 20.00 levels, respectively. The price is moving above the moving averages 50, 100, and 200 on the daily timeframe, as well as on the 4-hour and 60-minute timeframes, in a sign of the strong bullish general trend. Because of the divergence in monetary policy and the economic position of Turkey, and fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.

[ad_2]