[ad_1]

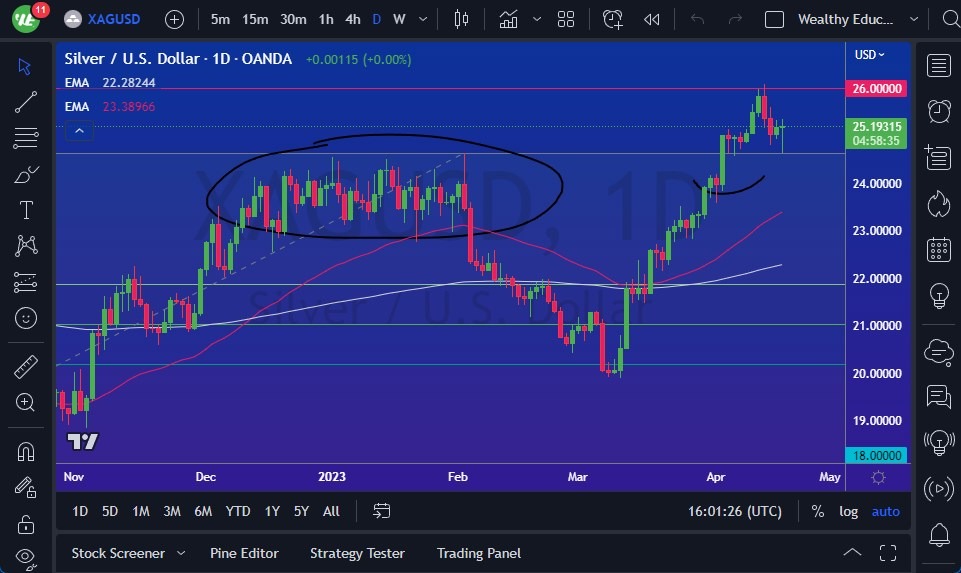

If the market fails to hold above the lows of the Wednesday trading session, we may see a decline toward the $24 level, which has been a magnet for prices over the past few weeks.

- Silver has been struggling in recent trading sessions, as the market continues to exhibit a high level of volatility.

- Despite the rough ride, it is still clear that there is a significant amount of buying interest, as the buyers are doing everything, they can to push the price up.

- The market managed to break above the $25 level, only to fall back below it, then showing signs of life once again. It seems that the “wealth preservation aspect” of silver is still a popular idea among investors as they try to navigate global economic uncertainties.

However, any move to the upside will likely face a lot of resistance and noise before it reaches the $27 level. Silver is expected to underperform gold in the long run because it is also an industrial metal, and the industrial demand is likely to shrink. Silver is still a precious metal, and it is expected to perform well in times of economic uncertainty.

If the market fails to hold above the lows of the Wednesday trading session, we may see a decline toward the $24 level, which has been a magnet for prices over the past few weeks. The 50-Day EMA could provide some psychological support in that area, but a break below it would signal a negative turn of events. Such a scenario could trigger some strength in the US dollar, making silver an unattractive option for investors.

Expect to see a lot of volatility in the silver market, as this is typical behavior. As an investor, the best thing to do is to keep a reasonable position size to avoid bigger losses than necessary. Ultimately, the “buy on the dips” strategy continues to be the best approach to silver, especially during times of global economic uncertainties and confusion.

At the end of the day, while silver has been volatile in recent trading sessions, the market is still displaying significant buying interest. The wealth preservation aspect of silver remains popular among investors, despite its industrial uses, and any move to the upside is expected to face resistance and noise. With the market expected to remain choppy, keeping a reasonable position size and following the “buy on the dips” strategy is the best approach for investors looking to take advantage of silver.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]