[ad_1]

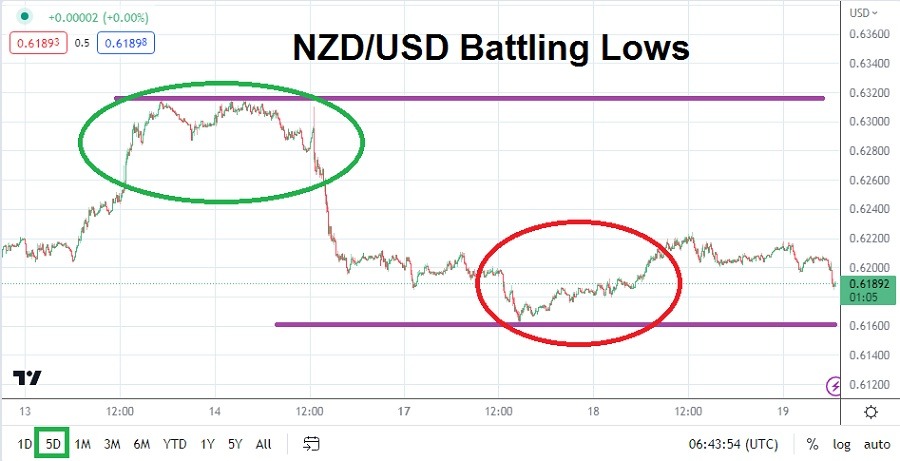

The NZD/USD has moved towards lows in early morning trading and is testing a critical support level that shows nervousness remains significant.

After trading near a high of almost 0.63150 on early last Friday, while coming in sight of important resistance levels, suddenly the NZD/USD took a nosedive which likely harmed some traders. The NZD/USD fell to a low below the 0.62000 mark later on Friday and finished slightly above the ratio going into the weekend.

The NZD/USD produced rather solid buying in the middle of last week on the notion U.S inflation data was slightly weaker than anticipated. However on Thursday and Friday of last week, rhetoric from U.S Fed officials began to deliver a chill into the financial markets as the central bankers warned inflation remains stubborn and more rate hikes may be needed. The selloff on Friday within the NZD/USD has continued to cause headwinds early this week.

New Zealand will release Consumer Price Index numbers early on Thursday, but the currency pair is getting a lot of its impetus from nervous financial institutions which may believe the USD has been oversold the past couple of weeks. Currently the NZD/USD remains under the 0.62000 ratio and is close to 0.61980 as of this writing. Support levels near the 0.61850 should be watched, the mark has seen a challenge this morning.

- The NZD/USD is near its one week lows and hovering within the lower depths of its one month chart too.

- While speculators who remain bullish regarding the NZD/USD over the mid-term certainly remain, the near-term continues to look choppy as financial houses try to price in their outlooks regarding the U.S Federal Reserve.

Traders who want to bet on the NZD/USD in the short-term are advised to look at technical charts and conclude where quick price action may work towards. The ability of the NZD/USD to produce downside action may lead to speculative wagers which seek quick hitting upside reversals from perceived lows. The 0.62000 ratio looks like it may produce a fight today and this could open the mark for a gauntlet of tests from speculators who believe it is a key psychological near-term value.

Traders should remain cautious regarding their targets in the short-term with the NZD/USD because the currency pair is likely to remain choppy. The USD has been slightly stronger in the past few days, but there is probably plenty of suspicion that its buying may run out of steam sooner rather than later, thus potentially making the New Zealand Dollar stronger. Speculators who want to look for upside from the NZD/USD cannot be blamed, but risk management will prove essential.

Current Resistance: 0.621125

Current Support: 0.61925

High Target: 0.62370

Low Target: 0.61640

[ad_2]