[ad_1]

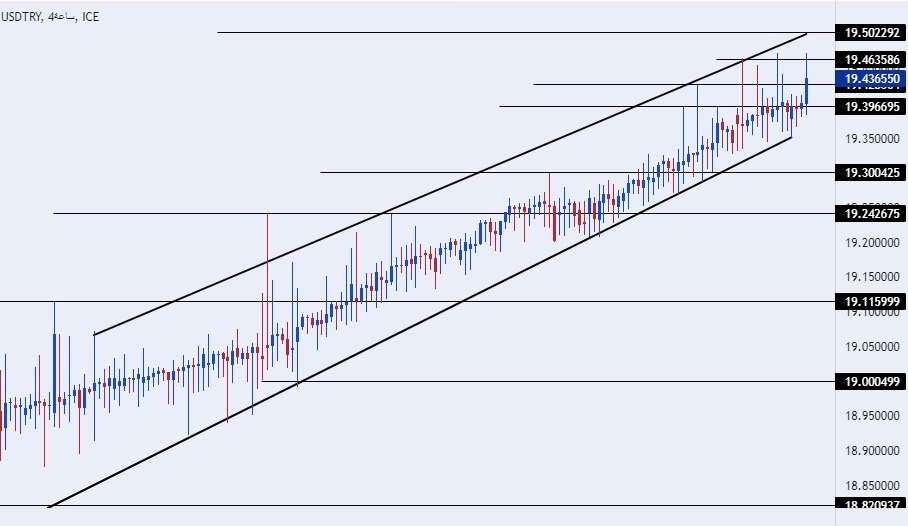

On the technical front, the dollar pair stabilized against the Turkish lira during today’s early trading, as the pair traded near its lowest levels ever, which it recorded during the current week, at 19.46 lira per dollar.

The risk is 0.50%.

- Entering a buy order pending order from the 19.00 level.

- Place a stop loss point to close below the 18.85 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the strong resistance level at 19.50.

- Entering a sell order pending order from the 19.50 level

- The best points to place a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the support level at 19.05.

The price of the TRY/USD settled near its lowest level ever against the US dollar, which it recorded during trading at the beginning of the week. The measures taken by the Central Bank of Turkey to reduce the demand for foreign currency seem to have recorded some positive results, especially with the stability of the price after a series of declines over the past two months. Western reports published a number of unofficial measures taken by the Turkish Central Bank to reduce demand for foreign currencies in light of the decline in the volume of foreign reserves suffered by the bank, which it used to maintain the balance of the Turkish lira. The size of the reserves of the Central Bank of Turkey has been affected after the devastating earthquake in Turkey about two months ago.

The uncertainty about the results of the Turkish elections also gives a greater negative impact on the price of the lira, in light of the most difficult elections that the ruling party, led by Recep Tayyip Erdogan, who has been in power in the country for nearly 20 years, is facing. Western reports suggested that the Turkish lira would decline, away from the identity of the winner in the elections, and that the ruling party if it won, would retreat from unconventional monetary policy, which could push the lira to rise by the end of this year.

On the technical front, the dollar pair stabilized against the Turkish lira during today’s early trading, as the pair traded near its lowest levels ever, which it recorded during the current week, at 19.46 lira per dollar. Currently, the pair is trading inside an ascending channel on the four-hour time frame, amid the dollar continuing to record gains against the lira, which is taking place with the pair’s slow rise, as the pair is trading above the support levels of 19.30 and 19.20, respectively.

On the other hand, the price is settling below the psychological resistance levels at the 19.50 and 20.00 levels, respectively. The price is moving above the moving averages 50, 100, and 200 on the daily timeframe, as well as on the 4-hour and 60-minute timeframes, in a sign of the strong bullish general trend. Because of the divergence in monetary policy and the economic position of Turkey, and fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.

[ad_2]