[ad_1]

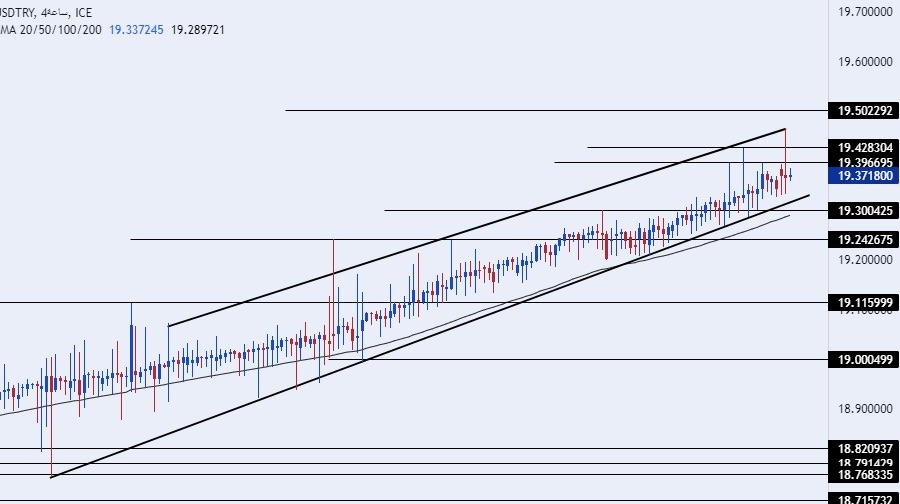

The pair traded above support levels at 19.31 and 19.20, respectively.

The risk is 0.50%.

- Entering a buy order pending order from the 19.00 level.

- Place a stop loss point to close below the support level at 18.75.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the strong resistance level at 19.11.

- Entering a sell order pending order from the 19.50 level.

- The best points to place a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the support level at 19.05.

The TRY/USD continued its losses against the dollar at the beginning of this week, as it is expected to record a loss for the seventh week in a row. The lira recorded record levels of decline during early trading, as the dollar recorded levels of 19.46 against the lira. The expectations of international banks and international institutions about raising Turkish interest in the period after the upcoming elections, regardless of the identity of the winning party in the elections. A report issued by Citigroup Bank indicated that it expected an interest rate hike to 40%, while Bank of America expected an interest rate hike to 50% before it recorded a decline by the end of this year.

The expectations represent a coup against the current Turkish president’s policy in the event that he wins the upcoming elections. Recep Tayyip Erdogan, who has long been singing about the importance of lowering interest rates, to which he pushed monetary policy in the Central Bank of Turkey over the course of several years, in a new economic policy that caused the lira to decline sharply against the dollar, may be ready to overturn his economic policy after he cut The interest rate to the single digits, in implementation of his previous promises. It is noteworthy that the expectations of international banks included a strong decline in the lira in the period following the elections, also away from the identity of the ruling party.

On the technical front, the dollar pair rose against the Turkish lira during early trading, as it recorded new levels of decline, recording 19.46 levels, with the pair continuing to rise during the past two months, to record new successive peaks. The pair is trading inside an ascending channel in the four-hour time frame, shown on the chart. The pair traded above support levels at 19.31 and 19.20, respectively. On the other hand, the lira is trading below resistance levels that are concentrated at the pair’s all-time highs at 19.46 and 19.42, as well as at the correct number at 19.50. The price settled above the moving averages 50, 100, and 200 on the daily time frame, as well as the price is trading above these averages on the four-hour time frame, in a sign of the bullish trend recorded by the pair in the long term. Any dip is a better buying opportunity. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.

[ad_2]