[ad_1]

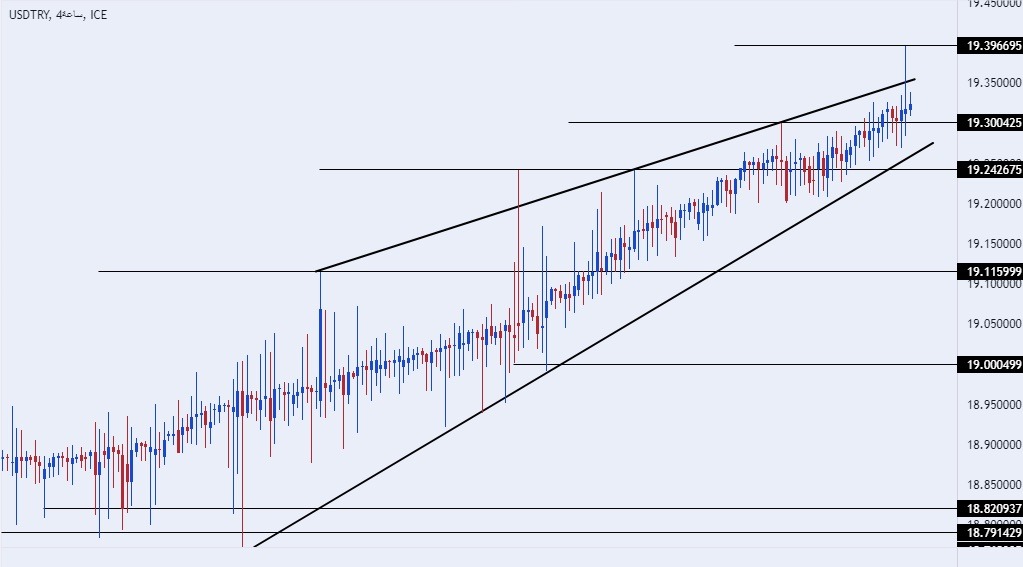

On the technical front, the USD/TRY rose during today’s early trading, as the pair recorded new highs, recording 19.39 liras per dollar.

The risk is 0.50%.

- Entering a buy order pending order from the 19.00 level.

- Place a stop loss point to close below the 18.85 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the strong resistance level at 19.50.

- Entering a sell order pending order from the 19.50 level.

- The best points to place a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the support level at 19.05.

The price of the TRY/USD fell to its lowest level ever against the US dollar during early trading on Thursday morning. A report published by Reuters said that the country’s central bank took more measures to reduce demand for foreign currency ahead of the crucial elections expected next month. As it increased pressure on commercial banks to increase transfers of foreign currency deposits into the local currency.

The country was facing a wave of foreign currency scarcity following the devastating earthquakes that struck the country about two months ago, as the bank’s ability to inject foreign currencies into the market in an attempt to support the price of the lira declined. Over the past month, the Central Bank took several steps to support the lira by putting pressure on commercial banks to reduce the demand for dollars and raise the percentage of deposits in pounds to 60%, according to reports.

Reserve is estimated at five billion dollars per month over six months. Additional pressure on the lira comes due to the unconventional economic policy pursued by the Turkish president, which is based on lowering interest rates with the aim of increasing exports and attracting tourism.

On the technical front, the USD/TRY rose during today’s early trading, as the pair recorded new highs, recording 19.39 liras per dollar. Currently, the pair is trading inside a rising wedge pattern on the four-hour timeframe, amid the dollar continuing to record gains against the lira, which is taking place with the pair’s slow rise. Currently, the pair is trading above the support levels at 19.20 and 19.10, respectively.

On the other hand, the price is settling below the psychological resistance levels at the 19.50 and 20.00 levels, respectively. The price is moving above the moving averages 50, 100, and 200 on the daily timeframe, as well as on the 4-hour and 60-minute timeframes, in a sign of the strong bullish general trend. Because of the divergence in monetary policy and the economic position of Turkey, and fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.

[ad_2]