[ad_1]

The USD/JPY jumped higher on Monday as the day progressed, this as U.S financial institutions began returning to their trading desks.

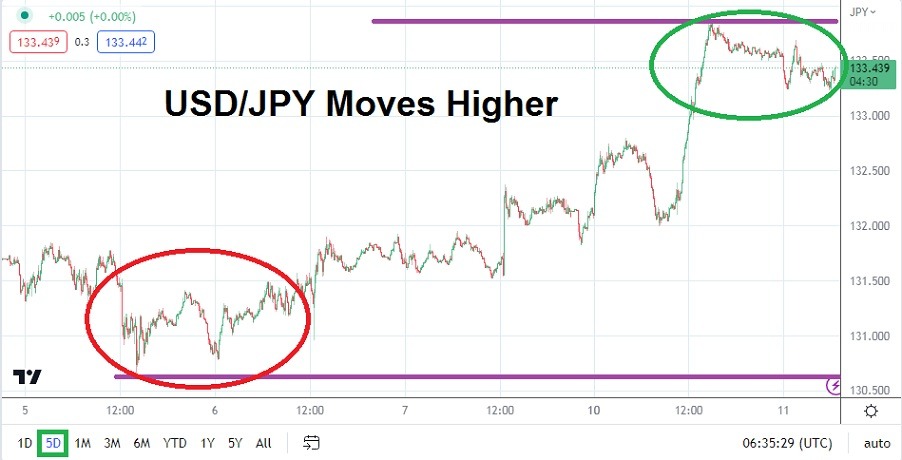

Since falling to a low of nearly 130.640 last Wednesday the USD/JPY has moved incrementally higher. The long holiday weekend affected trading volumes in the USD/JPY at the end of last week and the results within the currency pair had to be looked upon with suspicion. Having produced a rather solid bearish price range until the middle of last week and then seeing a slight reversal higher the USD/JPY seemed within a rather polite price range for speculators.

The yen is a popular asset during turbulent times.

However, upon the return to their trading desks yesterday in the U.S., it appears that financial houses began to show signs of nervousness and the USD/JPY suddenly began to climb with greater price velocity. Having started Monday’s trading near the 132.150 mark and then falling to a low around the 131.800 ratios, some speculators may have believed additional selling would be displayed and a test of support levels would continue. That did not happen.

Instead, the USD/JPY began to climb, and as the hours progressed buying of the currency pair remained strong, and eventually, a high of nearly 133.880 was demonstrated. Since this high yesterday the USD/JPY has seen some slight selling and the current price of the Forex pair is near the 133.480 mark as of this writing.

The ability of the USD/JPY to produce a strong upwards climb on Monday can be interpreted as a wave of buying being displayed in unbalanced markets which didn’t have enough selling to counterweigh the price action, thus the reason for the emergence of the rapid bullish move. However the USD/JPY can be argued from another perspective too. Being one of the world’s most heavily currency pairs, the move of the USD/JPY higher yesterday shows that ‘smart money’ within financial houses may suspect that the USD/JPY was price to low as they considered the potential of inflation data which will come from the U.S on Wednesday.

- CPI data tomorrow in the U.S. will cause instant volatility upon its release and the inflation reports will offer insights regarding U.S. Federal Reserve thinking.

- If the Consumer Price Index numbers come in stronger than anticipated, this would add fuel to the notion the U.S. central bank will raise interest rates by 0.25% in early May and could consider another hike in June.

The nervous sentiment seems to have shown its colors within the U.S. marketplace yesterday regarding the outcome of the key inflation reports that will be seen this week. The CPI report tomorrow will be followed by the Producer Price Index data on Thursday. Then to top off this week’s important economic indicators from the U.S. will be Retail Sales and Consumer Sentiment data on Friday. Perhaps the upwards move in the USD/JPY yesterday is showing some financial houses think inflation remains stubborn in the U.S. and the Federal Reserve will remain stubborn as well. Day traders should remain cautious in the near term and monitor the USD/JPY closely.

Current Resistance: 133.570

Current Support: 133.265

High Target: 133.950

Low Target: 132.950

[ad_2]