[ad_1]

The risk is 0.50%.

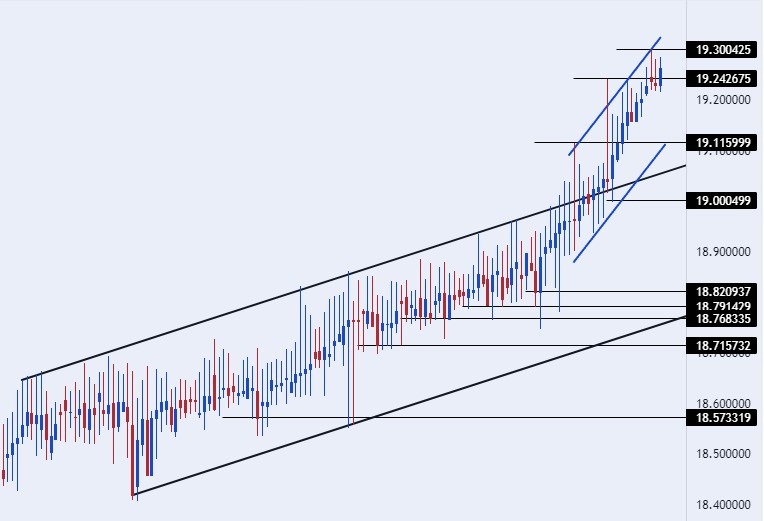

Best buy entry points

– Entering a buy order pending order from 19.00 levels

– Place a stop loss point to close below 18.85 levels.

– Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

– Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the strong resistance levels at 19.50.

Best selling entry points

– Entering a sell order pending order from 19.50 levels

– The best points to place a stop loss close at 19.65 levels.

– Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

– Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the support levels 19.05

The price of the Turkish lira stabilized against the US dollar during early trading this morning, near its lowest level ever. The Turkish currency concluded last week’s trading at new record levels of declines. Despite the positive data witnessed by the Turkish economy during the past month, the most prominent of which was the decline in inflation to reach 51.50 percent during the period, according to official data of the “Turkish Statistical Institute”, but some other data had a negative impact as the trade deficit widened.

Meanwhile, the Turkish Central Bank expanded its measures to support the lira, in conjunction with the decline in the bank’s ability to pump more foreign currencies into the markets as part of its efforts to maintain a stable price for the Turkish currency. Another measure of the Central Bank of Turkey was the issuance of a decree for commercial banks that eased the rules for saving in the Turkish lira by issuing short maturities for deposit accounts protected from fluctuations in the foreign exchange rate.

In addition to approving other measures that prevent commercial banks from retaining liquidity from foreign currencies, as those banks must deposit more foreign liquidity with the Central Bank in the event that the volume of deposits in pounds held by those banks is less than 60%. The Central Bank seeks to maintain the price of the lira ahead of the expected crucial elections next month.

- The dollar pair rose against the Turkish lira slightly during today’s early trading, as the price approached its all-time high, which it recorded during the past week at levels of 19.30 lira each.

- The pair had previously retested the upper boundary levels of the bullish price channel on the time frame.

- Today, which it breached during last month’s trading, and the price is trading inside a smaller price channel on the four-hour time frame, amid the dollar’s continuation of its gains against the lira, which is taking place with the pair’s slow rise.

Currently, the pair is trading above the support levels 19.11 and 19.00, respectively. On the other hand, the price is settling below the psychological resistance levels at the integer 19.50 and 20.00 levels, respectively. The price is moving above the moving averages 50, 100, and 200 on the daily timeframe, as well as on the 4-hour and 60-minute timeframes, in a sign of the strong bullish general trend. Because of the divergence in monetary policy and the economic position of Turkey, any fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.

[ad_2]