[ad_1]

The US dollar has been struggling to make any significant gains against the Japanese yen, as it quickly gave back its initial rally. With the market displaying a lot of volatile behavior, it is imperative to be cautious with your position size, as the market is poised to move back and forth in the near future. The USD/JPY pair has been hovering around the ¥131 level for some time now, as investors continue to ponder the Bank of Japan’s yield curve control measures.

The Bank of Japan has been closely monitoring the 10-year Japanese Government Bond yield curve, ensuring that it stays under 50 basis points. If interest rates rise, the central bank is quick to threaten the market with the printing of more currency to keep rates low. This was seen last year when the Japanese yen was hit hard, and the correlation continues as long as the Bank of Japan continues to restrict rates.

Meanwhile, the US dollar is experiencing fluctuations based on the expected monetary policy from the Federal Reserve. There is much debate as to whether the Fed will loosen its policy or continue with a tight monetary policy. The market remains divided on this issue, and this has put some pressure on the greenback. However, whenever a Federal Reserve speaker talks about tight monetary policy, it adds strength to the US dollar.

There are indications that the Fed may start loosening monetary policy by the end of the year, but this remains a contentious issue. As such, the markets are all over the place regarding the direction of the US dollar against the Japanese yen. It is therefore important to keep an eye on the market’s volatility and be cautious with your position sizing.

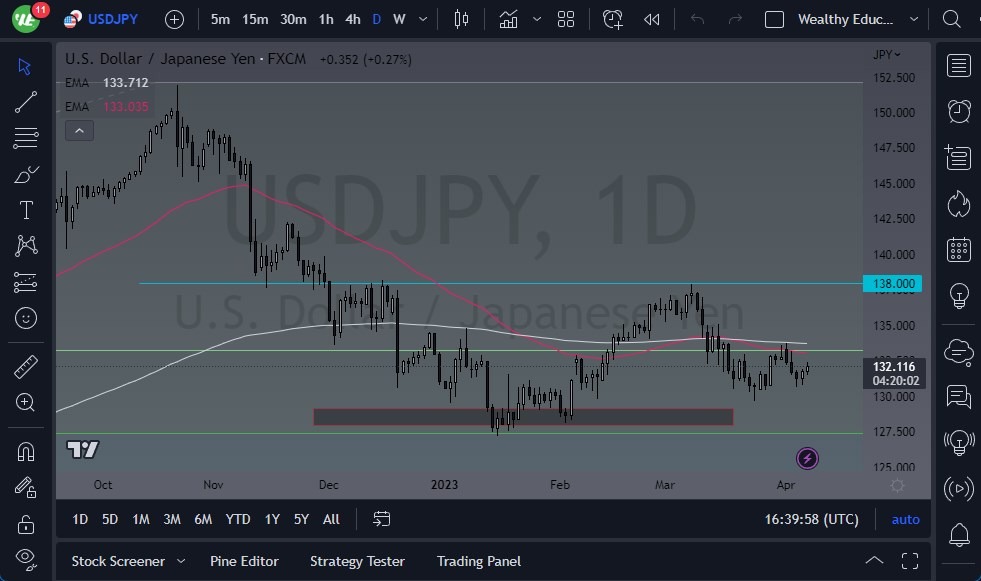

As the market continues to see a lot of back-and-forth behavior, the potential for major price swings is high. The USD/JPY pair may experience some downside pressure, with the 50-day exponential moving average acting as the support level. A break below the ¥131 level may send the market down to the 50-day EMA, which sits just above the ¥130 level.

On the other hand, a break above the ¥132 level on a significant daily close could signify a rally toward the ¥133.50 level. Therefore, traders need to pay close attention to both the technical and fundamental factors – especially in the bond markets – that may affect the USD/JPY pair, as they determine the direction of the market.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]