[ad_1]

The EUR/USD has rallied a bit during the trading week, but it still sees quite a bit of noise just above extending all the way to the 1.10 level. Ultimately, I think this is a market that will eventually find sellers, but if we were to break above the 1.1050 level, then you would have to give up any bearish idea and understand that we are entering a longer-term bullish run. A lot of this comes down to the Federal Reserve and expectations coming from monetary policy.

The USD/JPY has shown signs of strength again during the end of the week, as we had initially seen the greenback fall against the yen. That being said, the market has shown itself to be somewhat stable, and it looks as if it is trying to form some type of longer-term bottom. That being said, a lot of this comes down to the overall interest rate situation as the Bank of Japan continues to deal with yield curve control. Ultimately, I think this is a market that will make a bigger decision sooner or later, but right now it looks like we are trying to form some type of base.

Gold markets have had a very positive way, breaking above the $2000 level and even closing above it. Ultimately, the market looks as if the $2050 level will continue to be a barrier that the markets are trying to reach, but ultimately, I think given enough time we will see some type of exhaustion where the market could drop down below the $2000 level. However, any dip at this point would have to be thought of as a potential value play, as we have seen so much in the way of strength.

The GBP/USD has broken above the 1.25 level during the week, albeit very slightly. The weekly candlestick ends up being a little bit of a shooting star, and we are facing significant resistance just above. At this point, if the market were to break down below the bottom of the weekly candlestick, it’s very likely that we will try to go toward the 1.20 level. However, if we were to break above the top of the candlestick, then it’s possible that we could go looking to reach the 1.2750 level. Just above there, we have the 200-Week EMA indicator that normally offers a little bit of noise as well.

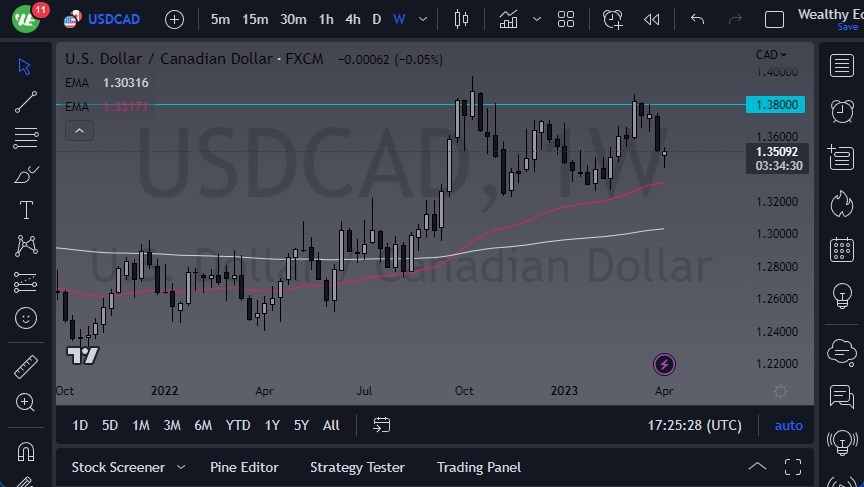

The USD/CAD initially dipped, but by the end of the week turned around to show signs of life as we end up the week forming a hammer. By doing so, the market looks as if it could make a move toward the 1.38 level, perhaps even the 1.39 level. The 50-Week EMA is sitting just below the 1.33 level, and I think that will offer a significant support level. That being said, oil gapped to kick off the trading week, but has yet to fill that gap. If it dies, that will obviously be negative for the Canadian dollar, so perhaps that’s what we are setting up for.

The AUD/USD initially tried to rally during the week but found a lot of resistance near the 0.68 level, a barrier that we have been paying attention to multiple times in the past. The fact that we formed an inverted hammer suggests that the US dollar is about to have a very strong week, so I think it is probably only a matter of time before you break down below the bottom of this candlestick, and perhaps go looking toward the 0.6550 level, and then the 0.65 level. Having said that, if we were to break above the 0.68 level, that would be an extraordinarily bullish sign, perhaps opening up but he moved to the 0.70 level.

The NZD/USD initially tried to rally during the week but has found enough resistance at the 0.64 level to show just how much selling pressure there is above. By forming a shooting star, the market suggests that we could break down a bit. I would anticipate a certain amount of support near the 0.6150 level underneath, but if we were to break down below there, then the market is likely to go looking to the 0.60 level, and perhaps even further to the downside. At this point, I think it makes quite a bit of sense that we will see a lot of noisy behavior, but the more volatility that we get, the more likely the US dollar is going to be the victor.

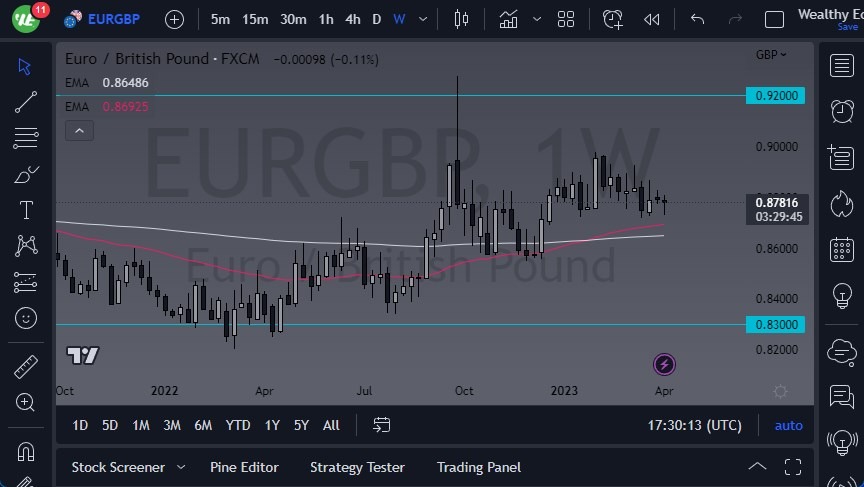

The EUR/GBP initially fell during the week against the British pound but continues to see a lot of support near the 0.87 level. Based on the recent trading history, it’s very likely that we could see a little bit of a bounce during the week, but it’s my opinion at this point that the 0.90 level above continues to be significant resistance. We are at the bottom of the overall consolidation area, so more of the same would be anticipated at this point in time, and therefore I think it’s worth looking for short-term buying opportunities.

[ad_2]