[ad_1]

The interest rate situation remains a significant factor, leading to a lot of noisy behavior in the market.

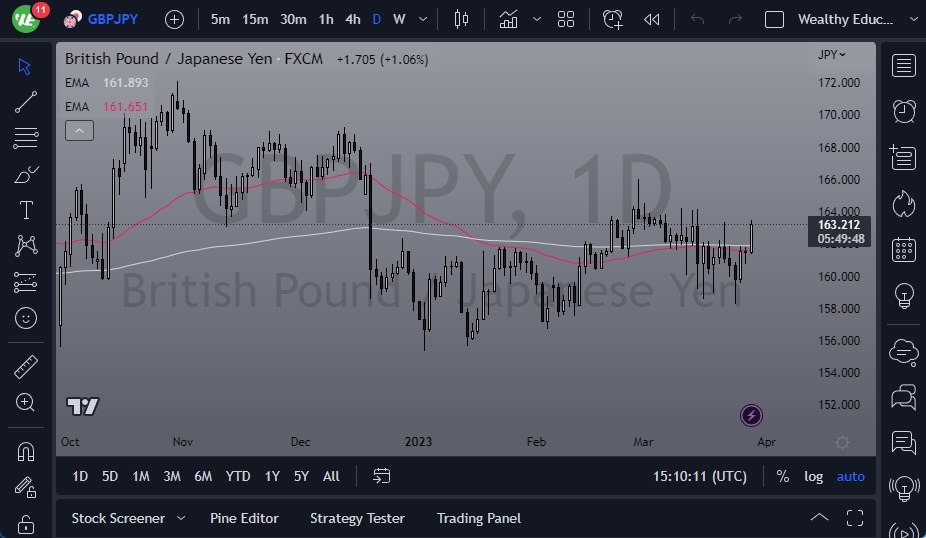

- The GBP/JPY has surged higher, breaking above the ¥162.50 level, which is an essential resistance level.

- However, an even more critical level is near the ¥165 level.

- The market is continually moving back and forth with the idea of interest rates in Japan, as the Bank of Japan continues its yield curve control to keep interest rates in the 10-year yield below 50 basis points.

Although the size of the candlestick is impressive, the market is still in a range. However, if it breaks above the ¥165 level on a daily close, there is a possibility that it could move toward the ¥167.50 level. Traders should be cautious and keep an eye out for the first signs of exhaustion above the ¥165 level, as it may be an opportunity to short the market for a short-term swing trade. The ¥160 level is expected to be a significant support level, worth paying attention to as a potential bottom.

The interest rate situation remains a significant factor, leading to a lot of noisy behavior in the market. Traders should keep their position size reasonable, as the market will continue to remain very volatile while traders try to figure out whether central banks are serious about raising interest rates or not. The entire market is fighting central banks, which means that there’s a lot of danger out there. The pair is also correlated to risk appetite, with it going higher as risk appetite rises, and falling as it struggles. Traders should keep this in mind as they analyze the market.

Ultimately, the British pound has broken above an essential resistance level but is still within a range. Traders should pay attention to the interest rate situation, keep their position size reasonable, and be cautious of the market’s volatility. By having a solid trading strategy, managing risk, and staying informed, traders can potentially navigate the Forex market with confidence and potentially achieve their financial goals. The Forex market is continually evolving, and traders need to be adaptable and patient to succeed. A perfect example is the fact that we are now paying attention to the 10-year yield in Japan more than anything else, but that may or may not remain for very long, therefore it’s likely that we would see the overall focus of the market shift rather soon.

[ad_2]