[ad_1]

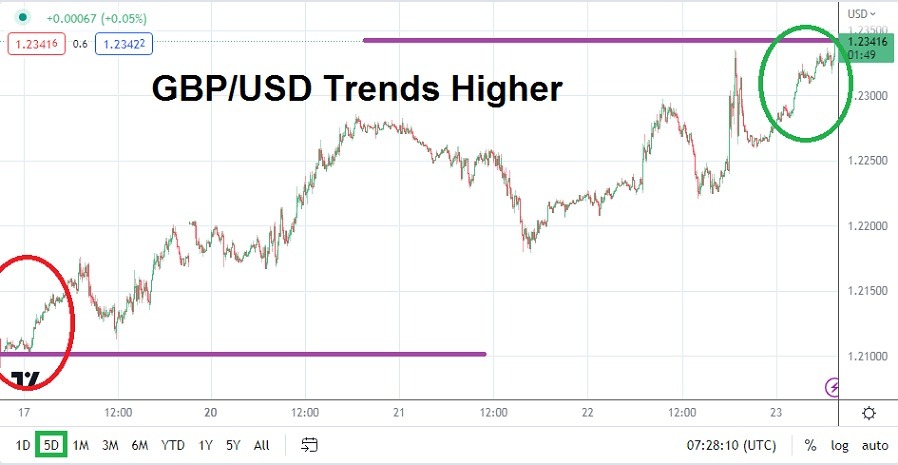

The GBP/USD is near the 1.23150 ratio as of this writing while challenging highs not seen since early February of this year.

The GBP/USD has moved higher in early trading this morning, building on upwards momentum generated late on Wednesday after the U.S Federal Reserve acted.

The GBP/USD is near the 1.23150 ratio as of this writing while challenging highs not seen since early February of this year. The resurgence of the GBP/USD bullish mode has been showing signs of life for nearly two weeks since the start of the banking crisis in the U.S and Switzerland.

Yes, the U.S. Federal Reserve did raise interest rates by 0.25% yesterday, but the central bank also indicated – likely not on purpose – that it is in a difficult place as it weighs inflation against concerns about the corporate banking sector. The Bank of England will announce its Official Bank Rate today and a quarter of a point hike is anticipated. Certainly, there are no guarantees regarding what the BoE will undertake today, but it seems likely the U.K central bank will not want to rock the financial boat and will mirror the Fed and ECB regarding rhetoric and actions.

Speculative pursuit of the GBP/USD higher may be attractive for day traders as they look at technical charts. However, traders are warned not to get overconfident and use risk management wisely. The GBP/USD could become volatile before and after the Monetary Policy Summary from the Bank of England.

What is interesting is the potential the BoE says it will have to remain vigilant regarding inflation. If they stress inflation more than recessionary concerns, this could mean the BoE will remain potentially more hawkish than the Federal Reserve in the coming months. The U.S. Fed essentially said yesterday they may consider another hike near-term, but that interest rate hikes may have to come later this year.

- The price velocity of the GBP/USD has been fast and resistance levels have proven vulnerable quickly.

- This sets up the contrarian notion the GBP/USD may have gained too swiftly and may face some short-term downward pressure, opening the door for choppiness today and tomorrow.

If the GBP/USD is able to maintain a value above the 1.23000 ratio near-term it may be a signal that more bullishness will drift into the currency pair. In late January and early February of this year the 1.24000 level was being touched in the GBP/USD. Traders should remain cautious in this environment.

The 1.24000 ratios may prove to be too ambitious a target for traders. However, the idea the GBP/USD can move higher if market conditions remain calm over the next week is attractive. The worthwhile wager may potentially be found for day traders who ignite buying positions after reversals lower than come within sight of perceived support ratios.

Current Resistance: 1.23200

Current Support: 1.22980

High Target: 1.23475

Low Target: 1.22540

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms in the UK to check out.

[ad_2]