[ad_1]

Trading in the USD/JPY has taken on a consolidated tone the past few hours as financial houses get ready for a long day ahead.

Traders of the USD/JPY have had the ability to watch a rather consolidated handful of calm results in one of the world’s most sophisticated Forex pairs. The USD/JPY in many respects acts as a barometer for risk appetite in the broad global marketplace. The scale of the USD/JPY transactional volumes and long history allows speculators’ perspectives to be tested based on past results.

The yen is a popular asset during turbulent times.

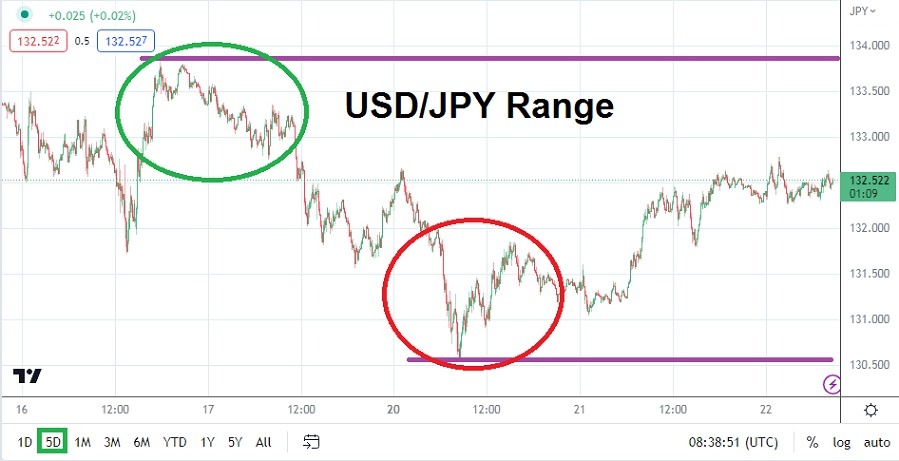

Technical trading is an important method to gauge behavioral sentiment in the USD/JPY and today’s coming results may present a variety of challenges. The USD/JPY is trading within the middle of its five-day price results as it hovers near the 132.500 level as of this writing. The low for the USD/JPY today has so far been around 132.250, while the high was near 132.785. Traders should not get lulled into a false sense of security, they should be fully aware the U.S Federal Reserve’s interest rate decision is approaching later today.

Price velocity and volatility are certain to develop in the USD/JPY; it is only a question of time when this will happen exactly. The monetary policy decision of the U.S Federal Reserve is always important in Forex, but today’s decision on the Federal Funds Rate and outlook which will be delivered by the U.S central bank could prove to be rather memorable. I do not want to overstate the circumstances, traders must stay calm and cautious today, but the Fed’s decision is being eagerly anticipated because there is a lot of disagreement regarding what direction the U.S. central bank should take.

Trading the USD/JPY will definitely become speculative leading up to the U.S Fed’s announcement later today and support and resistance levels are bound to be tested. Traders who choose to purse price fluctuations should have their take profits working. Since Monday the USD/JPY has trended slightly higher, this may be a sign that financial houses suspect the Fed will raise interest rates by 0.25% today. If this happens and traders have already digested the hike into the marketplace, then the Fed’s monetary policy statement will become a focal point regarding its outlook.

- The USD/JPY is certain to develop a hectic trading environment as the day progresses, and based on what the U.S. Fed announces will certainly affect behavioral sentiment in the Forex pair.

- Traders are advised to use leverage in a conservative manner and have all of their risk-taking tools working as they bet on the USD/JPY.

- Traders must be ready for consolidated price action to evaporate and for wide support and resistance levels to be tested later today.

Current Resistance: 132.600

Current Support: 132.400

High Target: 133.360

Low Target: 130.990

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.

[ad_2]