[ad_1]

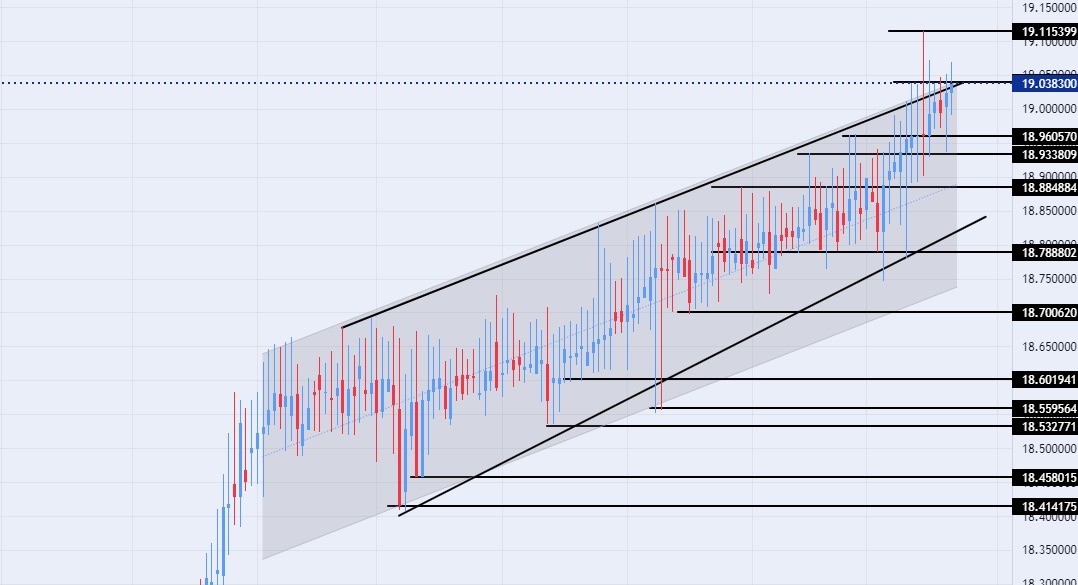

On the technical front, the TRY/USD rose slightly during today’s early trading, and the pair settled near its all-time high, recording 19.11.

The risk is 0.50%.

- Entering a buy order pending order from the 18.90 level.

- Place a stop loss point to close below the support level at 18.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

- Entering a sell order pending order from the 19.50 level.

- The best points to place a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the support level at 19.05.

The price of the TRY/USD has stabilized near an all-time low. Early reports published by Bloomberg revealed government plans to raise capital in state banks to expand lending operations ahead of the Turkish elections. According to the data, the capital increase is expected to increase by 74%, to reach $5.5 billion, compared to the original plans. The Turkish government’s plans come in an attempt to stimulate the economy ahead of the upcoming elections in less than two months.

The World Bank had previously published a report at the beginning of this year warning of increased government expenditures and its negative impact on inflation, which is declining at a slow pace in a country that recorded record levels of inflation over the past year. Despite previous reports indicating the possibility of the country’s president reversing his unconventional economic plan if he succeeds in the elections, the steps that Erdogan is taking at the present time are based on expanding the stimulus policy by increasing capital and cheap-interest loans. It is noteworthy that the country’s monetary reserves have recorded significant declines due to the devastating earthquake that struck the southwest of the country last month.

On the technical front, the TRY/USD rose against slightly during today’s early trading, and the pair settled near its all-time high, recording 19.11. It traded at 19.03 levels at the time of writing the report, maintaining the general bullish trend, with the pair failing so far to record any It closed outside the levels of the ascending channel on today’s timeframe, as the pair formed a rising wedge pattern on today’s timeframe.

With the pair’s upward movement continuing at a slow pace, the dollar against the pound is trading above the support levels of 18.90, 18.80, and 18.70, respectively. It is also trading below the resistance levels at 19.00 and 19.11, which represents the highest price for the pair ever, as well as the pair is trading below the psychological resistance levels at 19.50. The pair is trading above the moving averages 50, 100, and 200 on the time frame of today, in a sign of the general bullish trend on the large time frame, while the price is trading between these moving averages on the 60-minute time frame, in a sign of the slow movement of the pair. Any fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.

[ad_2]