[ad_1]

The broad Forex markets are nervous and the NZD/USD is mirroring these results with values that are for the moment lingering within a middle ground as if traders are waiting on the rate decision of the U.S Fed and its monetary policy outlook.

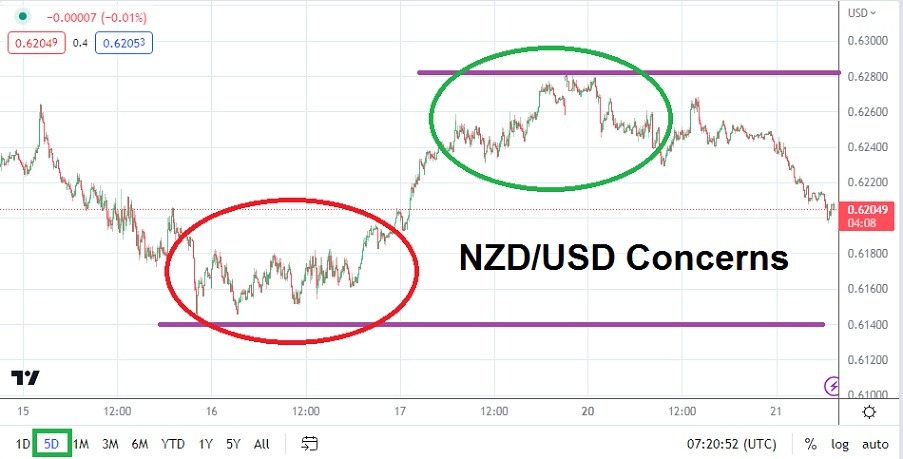

The NZD/USD is currently within the middle ground of its one-week trading range, highlighting the heightened sense of unknown which exists in the broad Forex markets currently.

As of this writing the NZD/USD is trading near the 0.62100 ratio, which is a value which that occupies the middle ground of its one-week price range. Last Friday the NZD/USD hit a high of nearly 0.62820, but since this high, the currency pair has seen an incremental selloff. However a low around the 0.62290 ratios was seen yesterday before a reversal higher challenged the 0.62690 mark. The frequent reversals in the NZD/USD are another piece of evidence the currency pair is awaiting impetus. The slightly stronger downturns show worries about the unknown.

Tomorrow the U.S. Federal Reserve will release its Federal Funds Rate decision and financial houses are uncertain about what the U.S. central bank will do. The notion late last week the Fed would have to at least momentarily halt its fight against inflation was heard rather loudly in the financial landscape, but the U.S Federal Reserve has not yet acknowledged this thought and some suspect it might actually raise rates.

The broad Forex markets are nervous and the NZD/USD is mirroring these results with values that are for the moment lingering within a middle ground as if traders are waiting on the rate decision of the U.S Fed and its monetary policy outlook. Financial houses are nervously taking into consideration the current banking sector trading conditions. Forex including the NZD/USD is awaiting guidance regarding interest rate policy. Until then trading conditions may be consolidated and this could open the door for speculators with strong stomachs.

- Traders of the NZD/USD who choose to pursue wagers today should have solid stop losses in place to guard against the potential of sudden developing news.

- Speculators who want to bet on upside buying action developing may be proven correct if the U.S. Federal Reserve does decide to halt its interest rate hikes momentarily.

- However, if the U.S. central bank remains stubborn and increases the Federal Funds Rate tomorrow this could ignite selling in the NZD/USD.

The temptation to trade in the NZD/USD may be quite attractive in the near term for speculators who feel they have an idea regarding what will happen with the Federal Reserve tomorrow. However, the past week and a half have been another vivid reminder that developing news can rattle financial markets. Confidence is very fragile for the moment and the NZD/USD is certain to react with fast trading at some point over the next day and a half. Traders who want to speculate on the NZD/USD in the short term should look for quick-hitting trades with narrow targets and strict stop losses as protection.

Current Resistance: 0.62190

Current Support: 0.62075

High Target: 0.62355

Low Target: 0.61980

[ad_2]