[ad_1]

Our expectations indicate a further decline for natural gas during its upcoming trading, especially as long as it stabilizes below 2.748, to target the pivotal and psychological support at 2.00.

Spot natural gas prices (CFDS ON NATURAL GAS) fell during their early trading on Wednesday, to record slight daily losses until the moment of writing this report, by -0.08%. It settled at a price of $2.566 per million British thermal units, after declining during yesterday’s trading by -2.10%.

Natural gas futures came under negative pressure on Tuesday, despite rising demand for the need to heat up due to weather and falling production. Concerns about inflation and panic in the financial sector seemed to have helped slow the positive momentum.

The April futures contract for Nymex natural gas fell by 3.3 cents per day, settling at $2.573 per mmbtu, and the May futures contract fell by 3.6 cents to $2,690.

Production in the United States fell on Tuesday from 100 billion cubic feet per day to 98 billion cubic feet per day, according to data from Bloomberg, as production slowed due to short-term maintenance projects.

Meanwhile, forecasts issued by the National Weather Service (NWS) continued to show increased demand for heating in the second half of March and into the first week of April. Its forecast showed multiple bouts of snowfall and freezing temperatures extending over large areas.

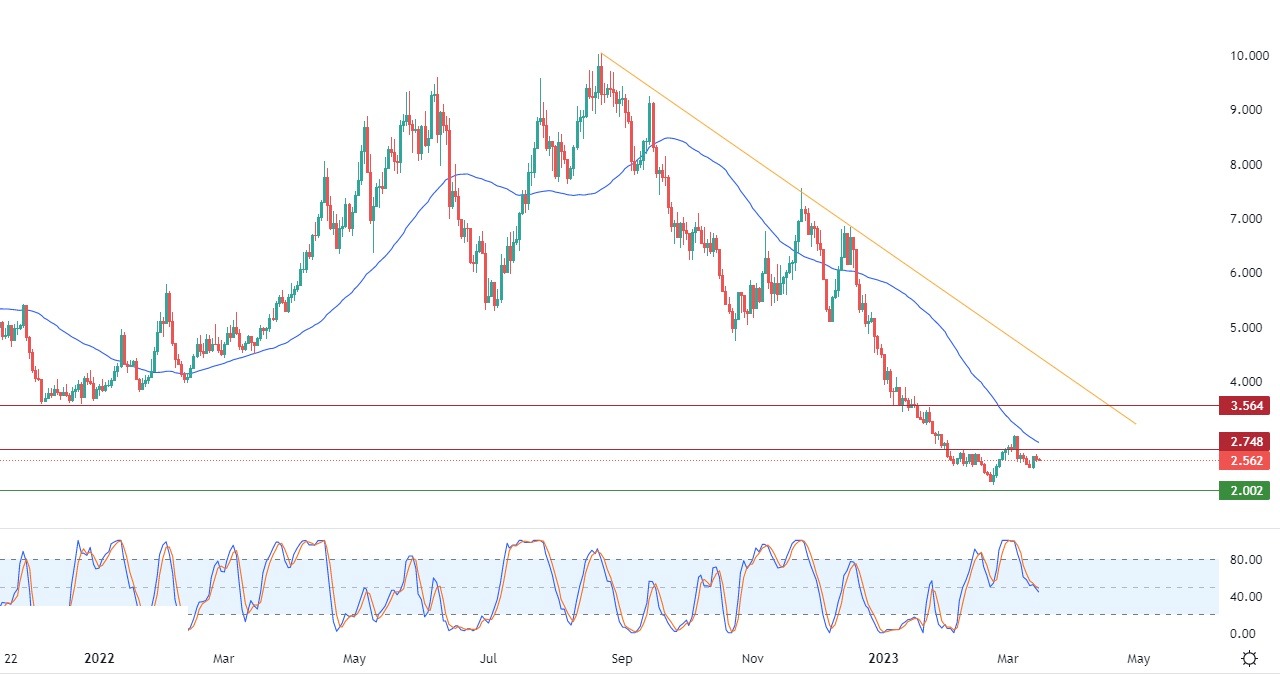

- Technically, the price was exposed to negative pressure due to the stability of the resistance level 2.748 that we talked about yesterday. Considering the complete control of the main bearish trend in the medium and short term and its trading along a bearish trend line.

- This is shown in the attached chart for a period (daily), with the continuation of the negative pressure due to its trading below the simple moving average for the previous 50-day period.

- Finally, it suffers from the continuation of negative signals in the relative strength indicators, after it reached earlier areas that were highly overbought.

Therefore, our expectations indicate a further decline for natural gas during its upcoming trading, especially as long as it stabilizes below 2.748, to target the pivotal and psychological support at 2.00.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.

[ad_2]