[ad_1]

The Kingdom of Saudi Arabia supports the reserves of the Turkish Central Bank by about five billion dollars

The risk is 0.50%.

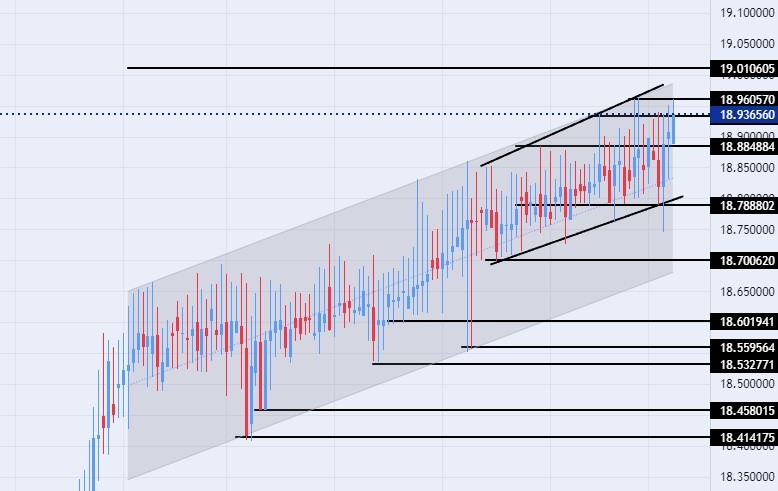

Best buy entry points

- Entering a buy order pending order from 18.80 levels

- Place a stop loss point to close below the support levels 18.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance levels at 19.00.

Best selling entry points

- Entering a sell order pending order from 19.00 levels

- The best points to place a stop loss close the highest levels of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support levels 18.75

The Turkish lira stabilized against the US dollar during early trading this morning. Investors followed reports about an agreement between the Central Bank of Turkey and the Saudi Fund for Development, where it is planned to deposit $5 billion, according to a statement issued at the beginning of this week.

The statement did not indicate details about the duration or date of the deposit. The agreement aims to strengthen the foreign exchange reserves of the Central Bank of Turkey, especially after a significant decline in the volume of foreign currency cash reserves. Inflation, which hit record levels in November last year. According to official data, net transfers of commercial banks abroad amounted to about 2.3 billion until mid-February. Meanwhile, the country’s central bank is considering approving some measures aimed at preventing banks from selling financial derivatives on the lira to their clients, in an effort to calm the demand for the dollar.

Last month, Turkey suffered from a devastating earthquake, whose losses, according to international estimates, amounted to approximately $35 billion.

The trading of the dollar pair against the Turkish lira stabilized without major changes during today’s trading. The pair maintained its general upward trend after the lira recorded record levels of decline against the dollar at the end of last month, after it touched 18.96 levels. At the same time, the pair continues to trade within the bullish channel on the daily time frame, and the pair is trading inside a smaller channel on the four-hour time frame.

With the pair continuing its upward movement at a slow pace, the dollar against the pound is trading above the support levels of 18.79, 18.70, and 18.63, respectively. The pair is also trading below the resistance levels at 18.96, which represents the highest price for the pair ever, and the pair is also trading below the psychological resistance levels at the integer number 19.00. The dollar pair against the lira is trading above the moving averages 50, 100, and 200 on the daily time frame, in a sign of the general bullish trend on the large time frame, while the price is trading between these averages on the four-hour time frame, in a sign of the slow movement of the pair.

Any fall of the dollar against the lira represents an opportunity to buy back again.

Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]