[ad_1]

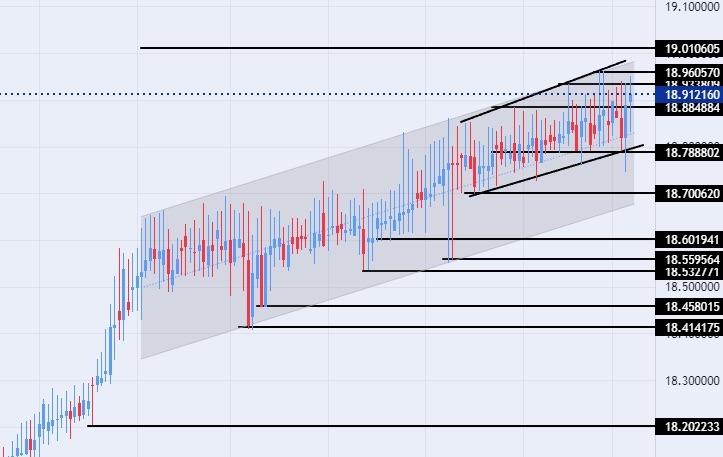

With the pair continuing its upward movement at a slow pace, the TRY/USD is trading above the support levels of 18.79, 18.70, and 18.63, respectively.

The risk is 0.50%.

- Entering a buy order pending order from the 18.80 levels

- Place a stop loss point to close below the support level of 18.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

- Entering a sell order pending order from the 19.00 levels.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 18.75.

The TRY/USD stabilized against the US dollar during early trading this morning. Reports from the World Gold Council revealed that the Turkish Central Bank topped the list of global central banks as the largest buyer of gold in the world during the month of January when it bought 23 tons. The Central Bank’s holdings reached a record of 565 tons of gold. In January, central banks bought 31 tons of gold, up 16% from December. Turkey stockpiled gold for months and was the largest buyer of gold by a monetary authority last year. Turkish families buy gold as a hedge against currency and inflation. The Turkish currency lost 44% of its value over the past year and 30% of its value during the first three months of this year. At the same time, inflation reached record levels last November, reaching 85%, before gradually declining over the past months. Last month, Turkey temporarily halted gold imports to mitigate economic damage from catastrophic earthquakes.

On the technical level, the trading of the dollar pair against the Turkish lira stabilized without major changes during the trading at the beginning of the week. The pair is moving in a generally upward direction after the lira recorded record levels of decline against the dollar at the end of last month after it touched the 18.96 level.

At the same time, the pair continues to trade within the bullish channel on the daily time frame, and the pair is trading inside a smaller channel on the four-hour time frame. With the pair continuing its upward movement at a slow pace, the TRY/USD is trading above the support levels of 18.79, 18.70, and 18.63, respectively. The pair is also trading below the resistance level at 18.96, which represents the highest price for the pair ever, and the pair is also trading below the psychological resistance level at 19.00.

[ad_2]