[ad_1]

The TRY/USD stabilized during early trading on Wednesday morning.

The risk is 0.50%.

- Entering a buy order pending order from the 18.80 level.

- Place a stop loss point to close below the support level at 18.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

- Entering a sell order pending order from the 19.00 level

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level of 18.75

The TRY/USD stabilized during early trading on Wednesday morning. A day after the issuance of data showing that the country’s gross domestic product increased during the past year, to record 5.6%, while economic growth declined during the last quarter of 2022, to record a slowdown that is expected to continue throughout the current year. Where the country is facing bad economic effects as a result of the natural disaster that struck the country during the past month, which left a number of victims close to 45,000 people, in addition to destroying about 10 provinces.

In this regard, the World Bank estimated that the amount of material damage may reach 34.2 billion dollars, while the value of reconstruction in the destroyed areas may double. In terms of data, the Istanbul Chamber of Industry issued a survey that showed a limited expansion of manufacturing activity in the country during the past month, as the manufacturing sector was negatively affected by the earthquake that struck the country during the past month. According to the data, the purchasing managers’ index in the country recorded stability at the same levels as in January, at 50.1 points, which is the figure that separates contraction from expansion. Factories’ input prices also recorded increases due to an increase in the prices of raw materials and workers’ wages.

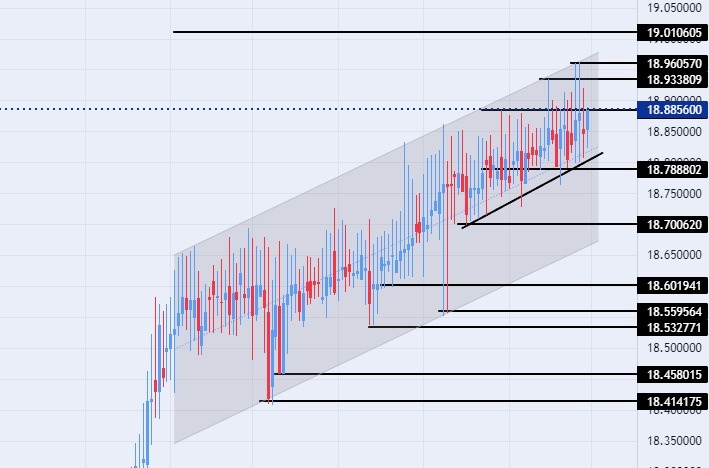

On the technical front, the USD/TRY traded unchanged during today’s early trading. The Turkish currency had recorded new records of decline against the dollar during the past month when it touched 18.96 levels. At the same time, the pair continued to trade within the levels of the ascending channel on today’s time frame, with the pair’s bullish movement continuing at a slow pace.

The pair is also trading inside a smaller price channel in the four-hour timeframe. The dollar pair against the lira is trading above the support levels of 18.79, 18.70, and 18.63, respectively. The pair is also trading below the resistance level at 18.96, which represents the highest price for the pair ever, and the pair is also trading below the psychological resistance level at 19.00.

The USD/TRY is trading above the moving averages 50, 100, and 200 on the daily time frame, in a sign of the general bullish trend on the large time frame, while the price is trading between these averages on the four-hour time frame, in a sign of the slow movement of the pair. Any fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

[ad_2]