[ad_1]

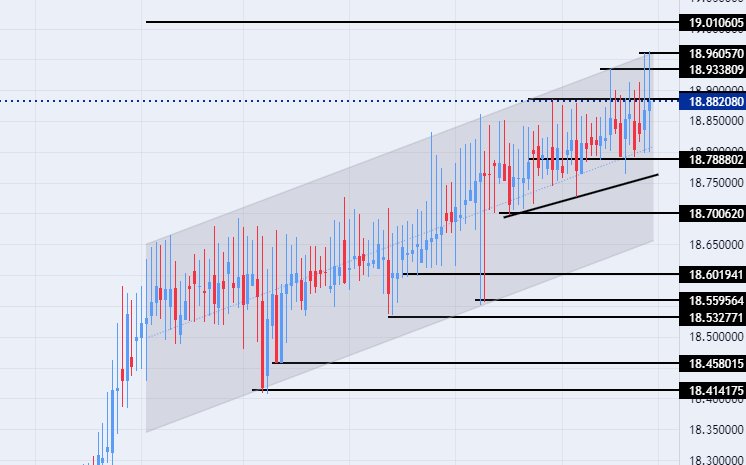

On the technical front, trading of TRY/USD stabilized during today’s early trading, after the Turkish currency recorded new records of decline against the dollar at the end of last week when it touched the 18.96 level.

The risk is 0.50%.

- Entering a buy order pending order from the 18.80 level.

- Place a stop loss point to close below the support level at 18.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 18.75.

The TRY/USD stabilized during early trading on Monday morning. The pair rose to record levels at the end of last week, with the rise of the US dollar amid expectations of further tightening of monetary policy in the United States of America, in conjunction with the Turkish Central Bank cutting the interest rate in the country by about 50 basis points during its meeting last Thursday. The decision of the Central Bank of Turkey was in accordance with analysts’ expectations, as the interest rate reached levels of 8.5%, compared to 9%, which remained unchanged during the months of January 2023 and December 2022.

The Central Bank of Turkey follows a policy of monetary stimulus, in contrast to the US Federal Reserve, based on the desire of the country’s president, who controls the Actual of the country’s central bank. In the meantime, the negative effects of the devastating earthquake that struck the south of the country at the beginning of this month continued, as a group of experts predicted that the inflation rate in Turkey would not decline from 40% until the middle of this year, due to the rise in food and housing prices, as inflation will decline at a slower rate than expected. Previous forecasts also revealed that the cost of the devastating earthquake will exceed about $50 billion.

On the technical front, trading of TRY/USD stabilized during today’s early trading, after the Turkish currency recorded new records of decline against the dollar at the end of last week when it touched the 18.96 level. At the same time, the pair continued to trade within the levels of the ascending channel on today’s time frame, with the pair’s bullish movement continuing at a slow pace.

The USD/TRY is trading above the support levels of 18.79, 18.70, and 18.63, respectively. The pair is also trading below the resistance level at 18.96, which represents the highest price for the pair ever, and the pair is also trading below the psychological resistance level at 19.00. The USD/TRY is trading above the moving averages 50, 100, and 200 on the daily time frame, in a sign of the general bullish trend on the large time frame, while the price is trading between these averages on the four-hour time frame, in a sign of the slow movement of the pair. Any fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

[ad_2]