[ad_1]

Without change, Early trading of the TRY/USD stabilized this morning, amid the country’s central bank for the price of the Turkish lira by pumping several billion into the markets.

The risk is 0.50%.

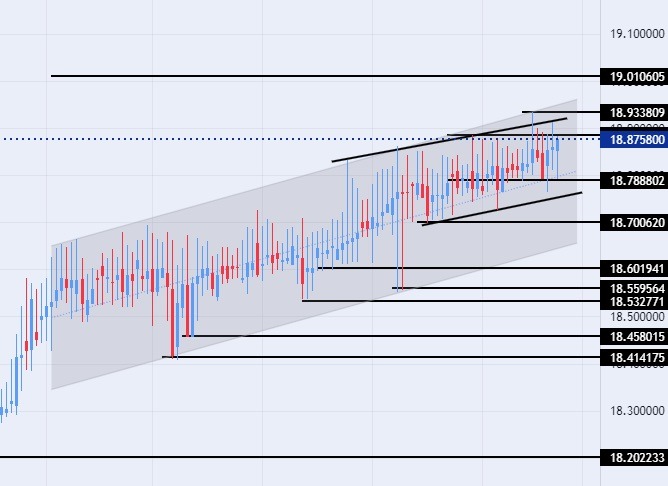

- Entering a buy order pending order from the 18.70 level.

- Place a stop loss point to close below the support level at 18.45.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 18.75.

Without change, Early trading of the TRY/USD stabilized this morning, amid the country’s central bank for the price of the Turkish lira by pumping several billion into the markets. Reports published yesterday revealed that the volume of foreign exchange reserves at the bank decreased by about seven billion dollars over the past two weeks, that is, since the earthquake struck the country. The natural disaster caused the death of about 40,000 people and the injury of about 250,000 others, in addition to various losses estimated at billions of dollars.

Over the past two weeks, the lira declined slightly, not exceeding 0.2%, as the support of the central bank helped stabilize the lira. According to official data issued by the Central Bank of Turkey, the volume of reserves decreased by about 4 billion dollars, to a record 125.6 billion, a week ago from now. The ruling party faces a real dilemma between facing the effects of the disaster and maintaining the stability of the markets at the same time, especially with the approaching date set for the fateful elections expected during the month of May. The World Bank has previously warned of an increase in government spending in the run-up to the elections, with the aim of preserving the popularity of the ruling party, which may push inflation to rise again.

On the technical front, there were no changes in the trading of the dollar pair against the Turkish lira during today’s early trading, after the Turkish currency recorded new record levels of decline against the dollar at the beginning of last week when it touched 18.94 levels.

At the same time, the pair continued to trade within the bullish channel levels on today’s time frame, with the pair continuing its bullish movement, albeit at a slow pace. The pair is also trading within a price channel in a smaller time frame. The dollar pair against the lira is trading above the support levels of 18.78, 18.70, and 18.63, respectively. The pair is trading below the resistance levels at 18.88 and 18.94, which represents the pair’s all-time high, and the pair is also trading below the psychological resistance level at 19.00.

The dollar pair against the lira is also trading above the moving averages 50, 100, and 200 on the daily time frame, while the price is trading between these averages on the four-hour time frame, in a sign of the general bullish trend for the pair. Any decline in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

[ad_2]