[ad_1]

On the technical front, trading of the dollar pair against the Turkish lira stabilized during today’s early trading, after the Turkish currency recorded new record levels of decline against the dollar at the beginning of last week when it touched 18.94 levels.

Today’s Recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.70 level.

- Place a stop loss point to close below the support level at 18.45.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 18.75.

Unchanged Early trading of the TRY/USD stabilized on Tuesday morning. A state of anticipation prevailed after a 6.4-magnitude earthquake hit an area near the Syrian-Turkish border on Monday, according to the Turkish Disaster and Emergency Management Presidency (AFAD).

The quake was recorded in the Defne district of Hatay province and was followed by another quake with a magnitude of 5.8 that hit Samandağ district, also in Hatay, local authorities said. Turkish Vice President Fuad Oktay confirmed that the earthquake hit the Turkish province of Hatay. Oktay said that eight people have been taken to the hospital so far, adding that the first tremor, which measured 6.4 on the Richter scale, was followed by about 20 aftershocks.

“Some of our buildings have been destroyed. Unfortunately, there are reports of people under the rubble. One of our bridges has also been destroyed,” said Lutvu Savvas, the district mayor.

The Disaster and Emergency Management Presidency (AFAD) also warned citizens to stay away from buildings as well as the coast, where sea levels are expected to rise by half a meter. For his part, Turkish Interior Minister Suleiman Soylu said that at least three people were killed and 213 injured in two new earthquakes in the southern part of the country.

TRY/USD Technical Analysis

On the technical front, trading of the dollar pair against the Turkish lira stabilized during today’s early trading, after the Turkish currency recorded new record levels of decline against the dollar at the beginning of last week when it touched 18.94 levels.

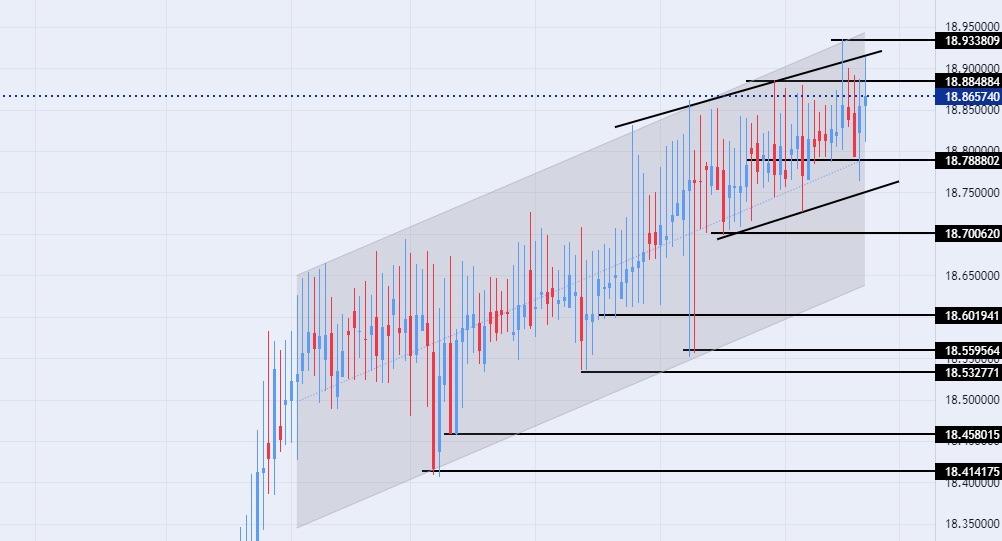

At the same time, the pair continued to trade within the bullish channel levels on today’s time frame, with the pair continuing its bullish movement, albeit at a slow pace. The pair is trading within a price channel on a smaller time frame. The dollar pair against the lira is trading above the support levels of 18.78, 18.70, and 18.63, respectively.

The pair is trading below the resistance levels at 18.88 and 18.94, which represents the pair’s all-time high, and the pair is also trading below the psychological resistance levels at 19.00.

The USD/TRY is also trading above the moving averages 50, 100, and 200 on the daily time frame, while the price is trading between these averages on the four-hour time frame, in a sign of the general bullish trend for the pair. Any decline in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

[ad_2]