[ad_1]

The USD/TRY is trading above the support levels of 18.70, 18.60, and 18.53, respectively.

Today’s recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.70 level.

- Place a stop loss point to close below the support level at 18.45.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support levels at 18.75.

The price of the TRY/USD has stabilized, amid continuing reports monitoring losses resulting from the earthquake that struck Turkey and Syria last week. In this regard, World Bank Vice President for the Middle East and North Africa Farid Belhaj said that the reconstruction of the areas affected by the catastrophic earthquake in the two countries will cost billions of dollars.

Although the World Bank has already allocated nearly $1.8 billion to Turkey to help it with its recovery efforts, the scale of the damage is much greater, according to other projections. In other news, reports revealed two main reasons for the rise in the current account deficit in Turkey during the past year, which recorded its highest level since 2018 after recording a deficit that exceeded 48 billion US dollars, as energy and gold imports were among the most important reasons that led to the expansion of the deficit.

Energy prices rose during the past year strongly, especially after the Russian invasion of Ukraine. Oil and natural gas prices jumped at a record rate after that, especially in light of Western sanctions on Russian energy exports, which contributed to the increase in prices, in addition to fears of declining stocks ahead of the winter season. On the other hand, gold imports were among the biggest reasons for the increase in the current account deficit, especially after Turkey’s gold imports increased by 543% to $3.1 billion in September. Previous statements by Central Bank Governor Sahhab Kafji revealed that Turkey would have recorded a surplus in the current account if energy and gold imports were excluded during 2022.

USD/TRY Forecast

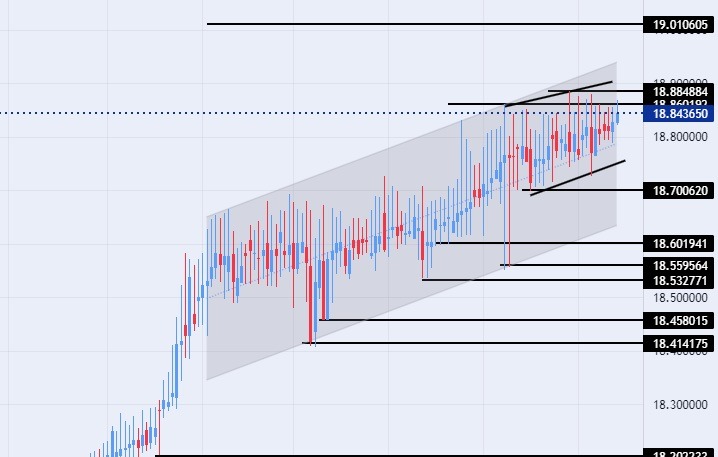

On the technical level, the trading of the USD/TRY stabilized without changes, recording slight movements near its all-time high at the 18.88 level, which the pair previously recorded at the beginning of this month. At the same time, the pair continued trading within the bullish channel levels on today’s time frame, as the pair continued its bullish movement, albeit at a slow pace. The pair also traded inside a smaller price channel in the four-hour time frame, indicating a narrow range of recorded trading.

The USD/TRY is trading above the support levels of 18.70, 18.60, and 18.53, respectively. At the same time, the pair is trading below the resistance levels at 18.83 and 18.88, which represents the highest price for the pair ever, as well as the pair is trading below the psychological resistance level at 19.00.

The USD/TRY is also trading above the moving averages 50, 100, and 200 on the daily time frame, while the price is trading between these averages on the four-hour time frame, in a sign of the general bullish trend for the pair. Any decline in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]