[ad_1]

Today’s recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.70 level.

- Place a stop loss point to close below the support level at 18.45.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance levels at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support levels at 18.75.

The price of the TRY/USD stabilized after data was released this morning from the Turkish Statistical Office, which showed an increase in retail sales in the country. It recorded 4.8% in January on a monthly basis, compared to 1.5% recorded in December, and retail sales increased on an annual basis, by 21.8%.

In the meantime, the focus continues on the economic consequences of the earthquake that struck the country, with an estimated death toll of about 28,000. According to internal reports issued by the Federation of Companies and Businesses in the country, the damages were estimated at more than $80 billion, including collapsed residential buildings, which amounted to 12,000 buildings, estimated at $70 billion.

Earthquake Affected About 13 million People

As for the external reports, Barclays Bank announced that it was too early to determine the size and amount of the damage caused by the disaster. Turkish Vice President Fuad Oktay revealed earlier that the Turkish authorities had launched investigations into the construction of thousands of buildings that collapsed in the earthquake and issued arrest warrants for more than 100 suspects.

The World Bank previously announced on Thursday that it will provide a combined relief package of $1.78 billion to Turkey to help recover after the devastating earthquake that struck the country and neighboring Syria. It is noteworthy that the losses exceeded the direct damages of the earthquake, as the damages included stopping the export of crude oil from the Turkish port of Ceyhan, in addition to the occurrence of some oil spills in some areas. Freight operations and air traffic were also suspended for several days.

TRY/USD Technical Analysis

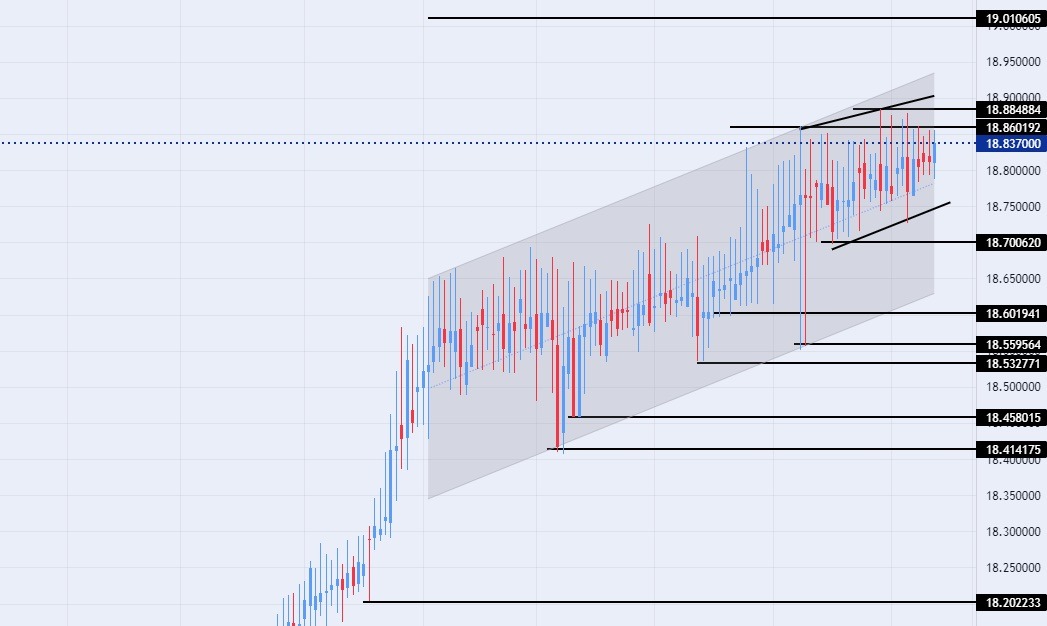

On the technical front, without changes, the dollar pair traded against the Turkish lira, recording slight movements near its all-time high at 18.88 levels, which the pair previously recorded at the beginning of this month.

At the same time, the pair continued trading within the bullish channel levels on today’s time frame, as the pair continued its bullish movement, albeit at a slow pace. The pair is trading above the support levels of 18.70, 18.60, and 18.53, respectively. At the same time, it is trading below the resistance levels at 18.83 and 18.88, which represents the highest price ever, as well as the pair is trading below the psychological resistance levels at 19.00.

The USD/TRY is also trading above the moving averages 50, 100, and 200 on the daily time frame, while the price is trading between these averages on the four-hour time frame, in a sign of the general bullish trend for the pair. Any decline in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]