[ad_1]

I think it’s very unlikely that Bitcoin suddenly takes off.

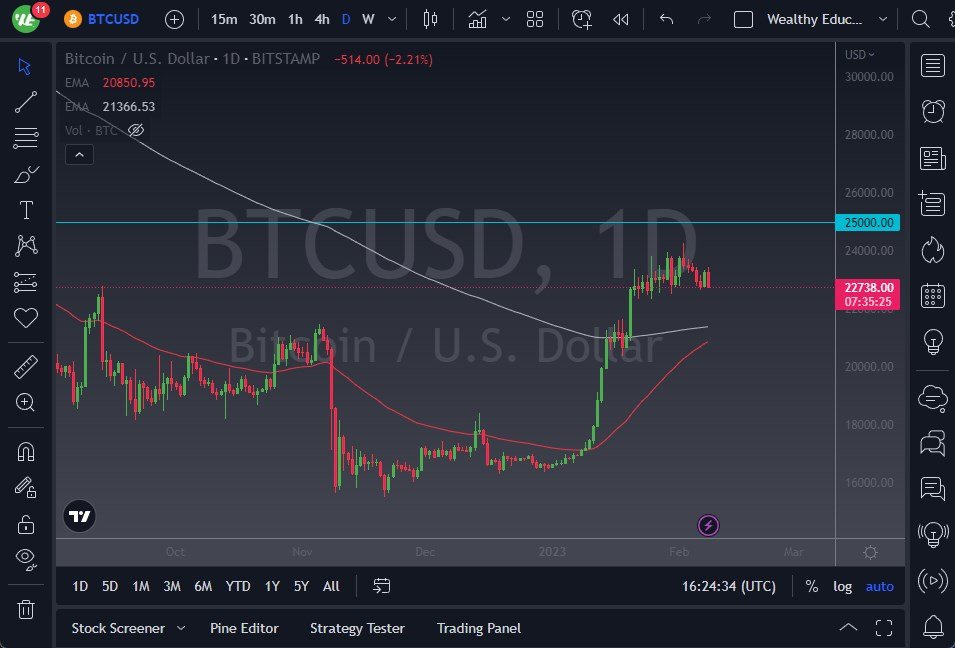

- Bitcoin has fallen rather hard during the trading session on Wednesday, as we continue to see a lot of hesitation up near the $23,000 region.

- Ultimately, this is the market that continues to see a lot of volatility, but if we give up the $22,000 level, I anticipate the Bitcoin is going to get hammered.

- This will almost certainly have something to do with the US dollar as well, because if it starts to strengthen, that will most certainly work against Bitcoin.

Bitcoin Is Choppy, Keep an Eye on Moving Averages

If we do break higher, we have a lot of noise between here and $25,000 to get above, so I think it’s very unlikely that Bitcoin suddenly takes off. Furthermore, a lot of what we have seen as of late has been due to the anticipation that the Federal Reserve may loosen monetary policy, and at this point it’s obvious that they are not overly excited to do so. While Wall Street tries to bully the Federal Reserve, the resolve of the Federal Reserve could be what causes the most amount of damage to this market.

When you look at this Forex chart, you can see that we had been a little overdone as of late, and the sideways action makes a certain amount of sense because of this. The market is going to be very noisy to say the least, but that’s nothing new for Bitcoin. Recently, it’s been choppier than anything else, so I think you need to keep an eye on the 200-Day EMA underneath, and of course the 50-Day EMA.

I do think that this is a market that is looking for some type of external pressure in one direction or the other to get things moving. Ultimately, I do think that the $25,000 level is a major gateway to higher pricing, so I also recognize that it will probably take a lot to get beyond there. If we do, then I think Bitcoin would go much higher. This would be a very bullish sign and could get this market rocking to the upside. At that point, we are probably looking at the $27,500 level, then possibly even the $30,000 level.

A breakdown below the 200-Day EMA is going to open up the possibility of even deeper cuts, perhaps down to the $20,000 level, right about where the 50-Day EMA has recently crossed over.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out.

[ad_2]