[ad_1]

Today’s recommendation on the Lira against the dollar

– Risk 0.50%.

Best buy entry points

– Entering a buy deal with a pending order from the 18.70 levels

– Place the stop loss point and close below the 18.45 support levels.

– Move the stop loss to the entry area and follow the profit with the price moving by 50 points.

– Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance levels at 19.00.

The best selling entry points

– Entering a sell deal with a pending order from the 19.00 levels

– The best points for placing a stop loss close at 19.15 levels.

– Move the stop loss to the entry area and follow the profit with the price moving by 50 points.

– Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support levels 18.75

Analysis of the Turkish lira

The price of the Turkish lira against the US dollar has stabilized near its all-time low. This is during the developments regarding the earthquake that hit the country early on Monday morning. The reports issued by the US Geological Survey indicate that there is a high probability that the economic losses from the initial earthquake may exceed one billion dollars.

The Turkish stock market had recorded strong collapses during yesterday’s opening after reports of heavy losses due to the earthquake. It is mentioned that an earthquake with a magnitude of 7.8 which hit Turkey and Syria killed more than 2700 people according to the latest information provided by the authorities of the two countries on Monday.

The head of the Turkish Disaster and Emergency Management Authority, Orhan Tatar, confirmed that more than 2,000 deaths have been recorded so far, while Syrian officials reported 968 victims, and the total number is expected to continue to rise. Tatar said earlier, during a press conference, that 6445 people were rescued, while 5606 buildings were destroyed.

Technical Outlook

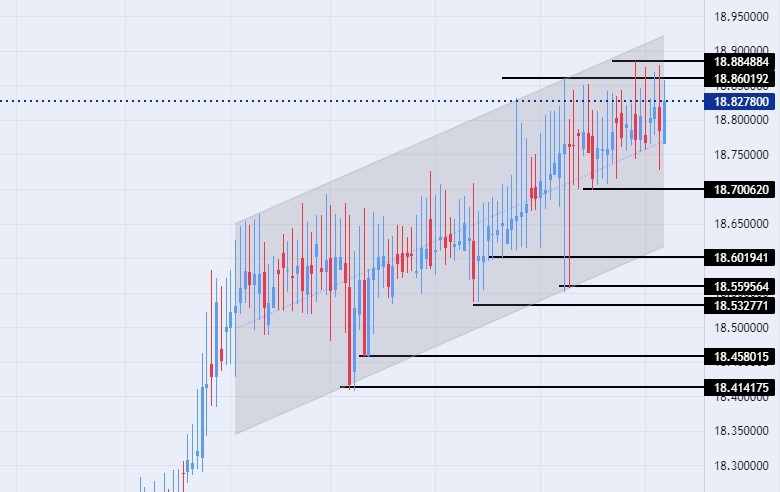

- The trading of the dollar pair against the Turkish lira stabilized as the pair witnessed slight movements near its highest levels ever at the levels of 18.88 which were recorded during the beginning of last week.

- The pair trades within the levels of the ascending price channel on the time frame of the day.

- This is in reflection of the upward movement of the pair, albeit at a slow pace.

- The dollar pair is trading above the lira support levels 18.70, 18.60 and 18.53 respectively.

On the other side, the pair trades below the resistance levels 18.83 and 18.88 which represents the highest price ever for the pair, as well as the pair trades below the psychological resistance levels at the correct number 19.00. The dollar pair against the lira also trades above the 50, 100 and 200 moving averages on the daily time frame as well as on the four-hour time frame in reference to the general upward trend of the pair. Any decline for the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation while maintaining capital management.

[ad_2]