[ad_1]

On the technical front, without changes, the dollar pair traded stable against the Turkish lira, as the pair witnessed slight movements near its all-time high at 18.88, which was recorded at the beginning of this month.

Today’s recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.70 levels

- Place a stop loss point to close below the 18.45 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.75 support level.

The price of the TRY/USD has stabilized, near its lowest level ever. Stock trading in the country continued to close after a large selling movement recorded by the markets after the opening and after the earthquake. At least 9,400 people died in the devastating earthquake that hit Turkey and Syria two days ago according to the latest updates on Wednesday.

The Turkish Disaster and Emergency Management Authority also confirmed that another strong tremor of magnitude 5.1 shook the same area today. The epicenter was recorded 5 km northwest of Goxon. After declaring a three-month state of emergency in 10 affected areas, Turkish President Recep Tayyip Erdogan will today visit some of the hardest-hit areas. At the same time, the Turkish Ministry of Defense said that the fire that broke out in the coastal city of Iskenderun, following a series of earthquakes in the region, had been put out. Earlier in the day, local media reported that the fire broke out after port operations were halted due to Monday’s massive earthquake, and black smoke was seen billowing from shipping containers. Some reports estimated the losses resulting from the earthquake to be around $1 billion.

USD/TRY Technical Analysis

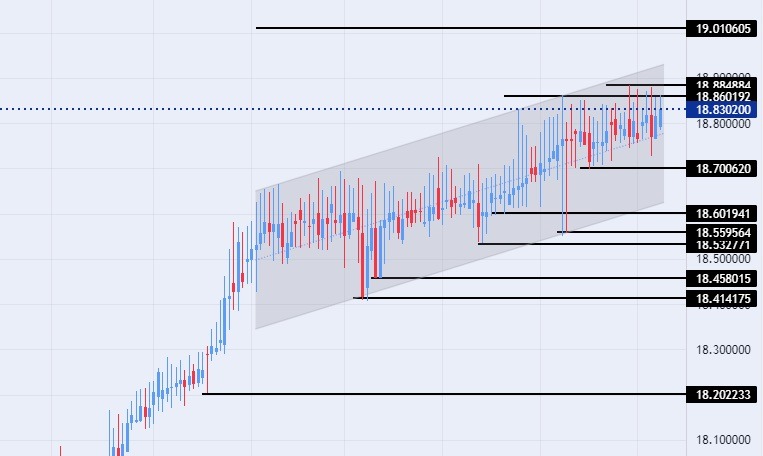

On the technical front, without changes, the dollar pair traded stable against the Turkish lira, as the pair witnessed slight movements near its all-time high at 18.88, which was recorded at the beginning of this month. The pair is trading within the levels of the ascending channel on today’s time frame, in a reflection of the upward movement of the pair, albeit at a slow pace.

Currently, the USD/TRY is trading above the support levels of 18.70, 18.60, and 18.53, respectively. On the other hand, the pair is trading below the resistance levels at 18.83 and 18.88, which represents the highest price for the pair ever, as well as the pair is trading below the psychological resistance levels at 19.00.

The USD/TRY is also trading above the moving averages 50, 100, and 200 on the daily time frame, while the price is trading between these averages on the four-hour time frame, in a sign of the general bullish trend for the pair. Any decline in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

[ad_2]