[ad_1]

The Freeport LNG export plant in Texas, which has been out of commission since the June fire, had planned to restart it by mid-January – and still expects it soon – but has yet to do so amid recent regulatory delays.

- Spot natural gas prices (CFDS ON NATURAL GAS) settled down during its early trading on Wednesday, recording daily losses until the moment of writing this report by -0.49%.

- It settled at $2.844 per million British thermal units, after rising slightly during yesterday’s trading, by 1.03%.

- During the month of January, the price decreased by -36.42%.

Natural gas futures settled on Tuesday supported by cold weather and a slight decline in production and strength in money markets after falling 17.2 percent in the first month on the previous day. March gas futures settled on Nymex on Tuesday at $ 2.684 per million units Thermal, an increase of about seven-tenths of a cent per day. The April contract rose by about one cent to $2,741.

Freezing weather on Tuesday spread from the Mountain West and Midwest to the south and east of the US. Cold conditions were expected to persist across much of the Lower 48 states for the remainder of the trading week, fueling heating demand.

Severe winter weather also temporarily halted production as far south as Texas, causing production to drop. Production fell by about 3 billion cubic feet per day to 97 billion cubic feet per day, according to Bloomberg estimates on Tuesday.

At the same time, demand for LNG is lighter than it could be due to the delayed reopening of an LNG plant in Texas.

The Freeport LNG export plant in Texas, which has been out of commission since the June fire, had planned to restart it by mid-January – and still expects it soon – but has yet to do so amid recent regulatory delays. A full restoration of the facility would add $2.38 billion. cubic feet per day of demand into the market, but at the moment this is still far from expectations.

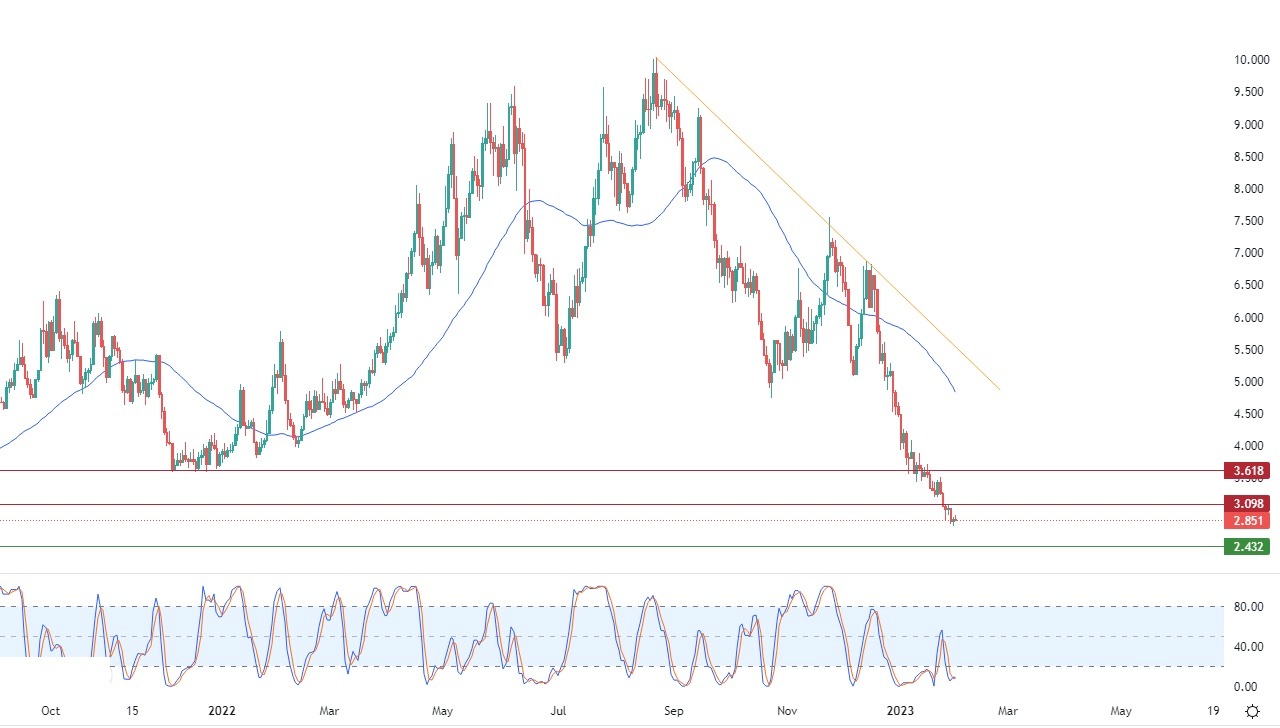

Natural Gas Technical Analysis

Technically, the bearish trend dominates the movement of natural gas in the short term, along a slope line. This is shown in the attached chart for a (daily) period, with the presence of negative signals in the relative strength indicators, despite its stability in highly saturated areas with selling operations. Considering the continuation of the negative pressure of its trading below the simple moving average of the previous 50 days.

Therefore, our negative expectations surrounding natural gas remain valid, especially as long as it stabilizes below 3.098, targeting the first support level at 2.432.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodity trading brokers to check out.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodity trading brokers to check out.

[ad_2]