[ad_1]

On the technical front, the USD/TRY recorded its highest levels ever during early trading this morning, as the pair recorded 18.88 levels, before retreating to the trading range in which the pair settled for several months.

Today’s recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.70 level.

- Place a stop loss point to close below the 18.45 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.75 support level.

The Turkish lira recorded new levels of decline during early trading on Monday morning, as it reached its lowest level ever against the dollar before rising slightly. Investors followed new measures from Turkey’s central bank in a bid to encourage exporters to hold less foreign currency as Recep Tayyip Erdogan’s administration intensifies its war to defend the lira ahead of crucial elections set for the middle of this year, according to the program launched on Thursday. A subsidy of 2% “conversion subsidy” is when companies convert their foreign currency earnings into lira with the Central Bank and have agreed not to purchase foreign currency for a predetermined period of time.

In the first half of this year, the central bank hopes to increase the proportion of deposits in the lira in the banking system to 60%. Multiple measures of the Turkish Central Bank to control the declines of the lira and control its levels in light of the divergence of monetary policy between the Turkish Central Bank and the US Federal Reserve, where the Central Bank of Turkey follows a stimulus monetary policy, while the Federal Reserve tightens monetary policy, which negatively affects the price of the Turkish lira, which the Turkish Central Bank is trying to support it in various ways.

TRY/USD Technical Analysis

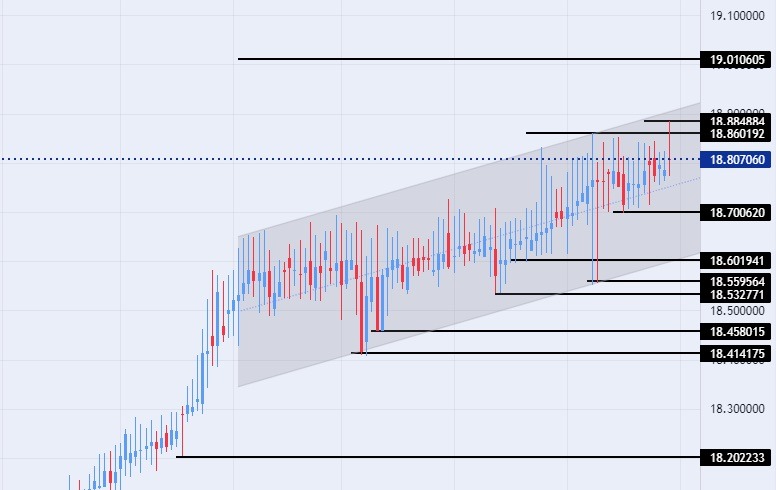

On the technical front, the USD/TRY recorded its highest levels ever during early trading this morning, as the pair recorded 18.88 levels, before retreating to the trading range in which the pair settled for several months. The pair continued trading within the bullish channel levels on today’s time frame, which reflects the upward movement of the pair, albeit at a slow pace. The USD/TRY is also trading above the moving averages 50, 100, and 200 on the daily time frame as well as on the four-hour time frame, in a sign of the general bullish trend for the pair. Currently, the USD/TRY is trading above the support levels of 18.70, 18.60, and 18.53, respectively.

On the other hand, the pair is trading below the resistance levels at 18.83 and 18.88, which represents the highest price for the pair ever, and the pair is also trading below the psychological resistance levels at 19.00. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]