[ad_1]

The question now is whether Jerome Powell makes that happen after his speech on Wednesday after the Federal Reserve is more likely than not going to raise rates.

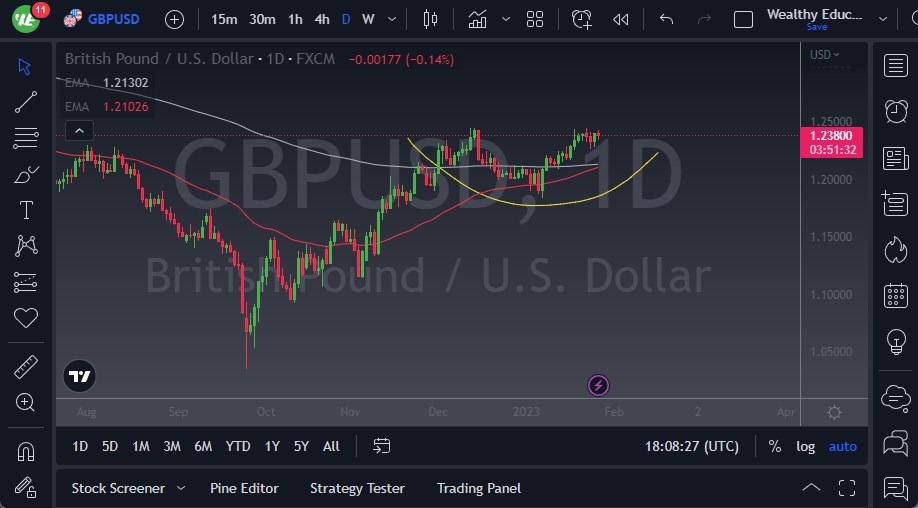

- The GBP/USD has rallied significantly over the last several weeks, but during the day on Thursday, has seen a lot of choppy behavior with a 1.24 level offering resistance.

- Ultimately, this is a market that I think continues to look at the 1.24 level as significant resistance that extends all the way to the 1.25 handle.

- That obviously is a large, round, psychologically significant figure, and therefore think a lot of people will be paying close attention to it.

If we were to break above the 1.25 level, then it’s likely that we go down to the 1.2750 level. On the other hand, if we turn around break down below the 1.23 level, then we are likely to test the moving averages underneath. Speaking of that is moving averages, it’s the 50-Day EMA in the 200-Day EMA.

Waiting for Jerome Powell’s Speech

The 50-Day EMA is trying to break above the 200-Day EMA, which is what is known as a “golden cross.” The indicator is one that longer-term traders like, but quite frankly it’s typically late. If we were to break down below these moving averages, then I think it’s likely that we could go much lower. The question at this point is whether we will continue to go lower. In that situation, the market would very likely break below the 1.20 level, and then down to the 1.15 level after that.

You can see that I have a yellow line drawn on the chart, it does suggest that we are in some type of rounding bottom as well, but you can also make an argument for a double top. Haven’t kicked off the double top yet, but if we get some type of negative momentum all of a sudden, that could be the beginning of something rather ugly. The question now is whether Jerome Powell makes that happen after his speech on Wednesday after the Federal Reserve is more likely than not going to raise rates. The question is whether he does something to be down the market in the process. Right now, this looks like a market that just does not know exactly what to do, but when I look across various asset classes, I can say the same about a lot of different things.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.

[ad_2]