[ad_1]

On the technical front, the trading of the USD/TRY recorded slight changes near its all-time highs.

Today’s recommendation on the USD/TRY

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.70 level.

- Place a stop loss point to close below the 18.45 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.75 support levels.

The Turkish lira stabilized against the dollar, without major changes, during morning trading today, Thursday. Investors followed positive comments from the Governor of the Central Bank of Turkey on the future outlook for inflation.

Where, Shihab Kavji Oglu said, the factors that caused the rise in prices in the markets before that do not exist now, and he added that the growth of his country’s economy during the last quarter of 2019 before the pandemic had ranked first among the economies of the G20 countries, despite the declining lira at the time. As for inflation expectations in the country during the current year, the governor of the Central Bank said that expectations indicate that inflation will reach 22.3% at the end of this year, with a further decline to reach 8.8% at the end of 2024. It is noteworthy that inflation in Turkey has reached 64%, according to the latest data issued by the Turkish government. It was down from its highest level in 25 years, recorded in November, when inflation reached 85%.

The Central Bank of Turkey, which is effectively under the control of the country’s president, had made a series of interest rate cuts at the end of 2022 before fixing it during the last two meetings after rates reached 9%.

USD/TRY Technical Analysis

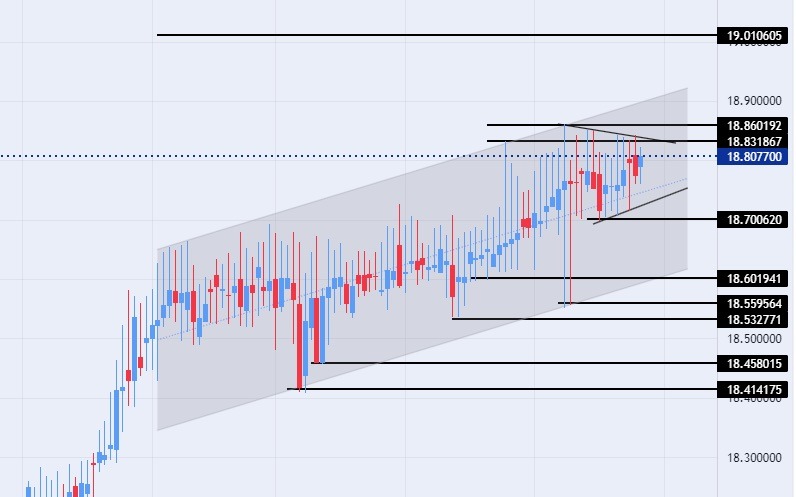

On the technical front, the trading of the USD/TRY recorded slight changes near its all-time highs. The pair continued to trade within the levels of the bullish channel on today’s time frame, which reflects the upward movement of the pair, albeit at a slow pace. At the same time, the pair is trading inside a symmetrical triangle on a smaller time frame. The USD/TRY is also trading above the moving averages 50, 100, and 200 on the daily time frame as well as on the four-hour time frame, in a sign of the general bullish trend for the pair.

Currently, the dollar against the pound is trading above the support levels of 18.70, 18.60, and 18.53, respectively. On the other hand, the pair is trading below the resistance levels at 18.83 and 18.86, which represents the highest price for the pair ever, and the pair is also trading below the psychological resistance levels at 19.00. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]