[ad_1]

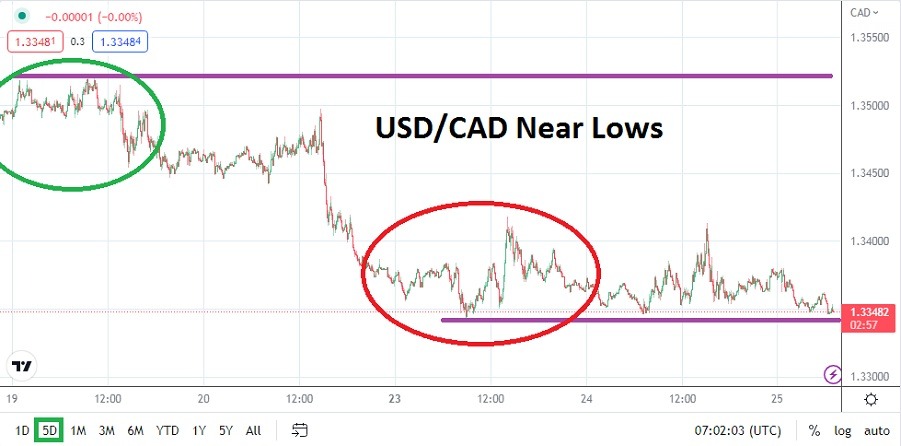

The USD/CAD is trading near important mid-term lows as speculators brace for the Bank of Canada to release the Overnight Rate today which will lead to volatility.

The USD/CAD is traversing near the 1.33600 ratios as it hovers close to critical mid-term lows. The downward trend of the USD/CAD built up power last week and has sustained its lower depths achieved before going into the weekend and the start of this week’s trading. Reversals have been seen to the upside, but they have not been particularly violent.

Bank of Canada will issue its Monetary Policy Report Today

Traders however should not become accustomed to the rather polite trading being demonstrated currently while important lows are being flirted upon. The Bank of Canada will issue its Monetary Policy Report today and the central bank’s outlook will certainly cause a storm in the USD/CAD. The BoC is expected to raise its key lending rate by a quarter of a basis point (0.25%) bringing the borrowing costs to 4.50%.

The USD/CAD and its ability to hover near 1.33500 may look like a focal point in the short term, but technical traders should not expect this to be the lynchpin in today’s trading. It is more likely that the 1.33450 to 1.33400 support level will be a key target for speculators if they are looking for downward price action. In the hours leading up to the Bank of Canada’s rate hike and outlook, traders should be braced for price velocity to quicken and become dangerous with swift reversals which test support and resistance levels.

USD/CAD January’s Bearish Trend has brought November 2022 Values into Sight

- On the 13th of January, the USD/CAD was trading near the 1.33200 mark briefly. By the 19th of January, the USD/CAD reached a high of around 1.35200. The move lower since the reversal higher has been rather strong.

- Risk management cannot be overstated for traders who want to pursue the USD/CAD today. Because of the Bank of Canada’s coming rate announcement, wagering on the USD/CAD beforehand should be done with very narrow price targets and conservative leverage.

The Bank of Canada will likely mirror the U.S. Federal Reserve’s policy, warning about inflation while saying it is monitoring growth. In other words, the BoC will likely not produce an earth-shattering news event today, what it will likely do is try to set a calm tone. However, trading in the USD/CAD will not be tranquil, cautious traders might want to sit on the sidelines until the new Overnight Rate is official and the BoC gives clues about its economic outlook.

Traders who want to pursue more downward price action in the USD/CAD cannot be faulted, but doing so today could prove to be dangerous. Conditions will become less volatile after a couple of hours following the BoC pronouncements, but until then the USD/CAD could produce swift and dangerous speculative waters.

Canadian Dollar Short-Term Outlook:

Current Resistance: 1.33810

Current Support: 1.33410

High Target: 1.34320

Low Target: 1.32875

[ad_2]