[ad_1]

On the technical front, the Turkish lira recorded slight changes against the dollar.

Advertisement

Today’s recommendation on the USD/TRY

Risk 0.50%.

Best Buying Entry Points

- Entering a long position with a pending order from levels of 18.50

- Set a stop-loss point to close below the 18.35 support level.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit of 70 pips and leave the rest of the contracts until the strong resistance levels at 18.99.

Best-selling entry points

- Entering a short position with a pending order from levels of 18.99/

- The best points for setting stop-loss are closing the highest levels of 19.15.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support level.

The price of the USD/TRY stabilized on slight changes, amid the absence of any impact of the data with the clear intervention of the Turkish Central Bank in the currency exchange market to prevent a significant decline in the price of the lira. Investors followed the Turkish government’s announcement of raising the volume of energy subsidies by 80 percent, as part of the 2023 budget. Government subsidies include 80 percent of gas consumption and 50 percent of electricity consumption consumed by Turkish families. This support aims to reduce the impact of high inflation in the country, especially with the country’s turnout for crucial elections next year, which will determine the fate of Turkish President Tayyip Erdogan, who has been in power for nearly 20 years. It is noteworthy that energy prices. Prices rose after Russia’s invasion of Ukrainian territory, are primarily responsible for the rise in inflation in the country, which exceeded 84 percent, according to the latest data issued by the country’s statistics office.

USD/TRY Technical Analysis

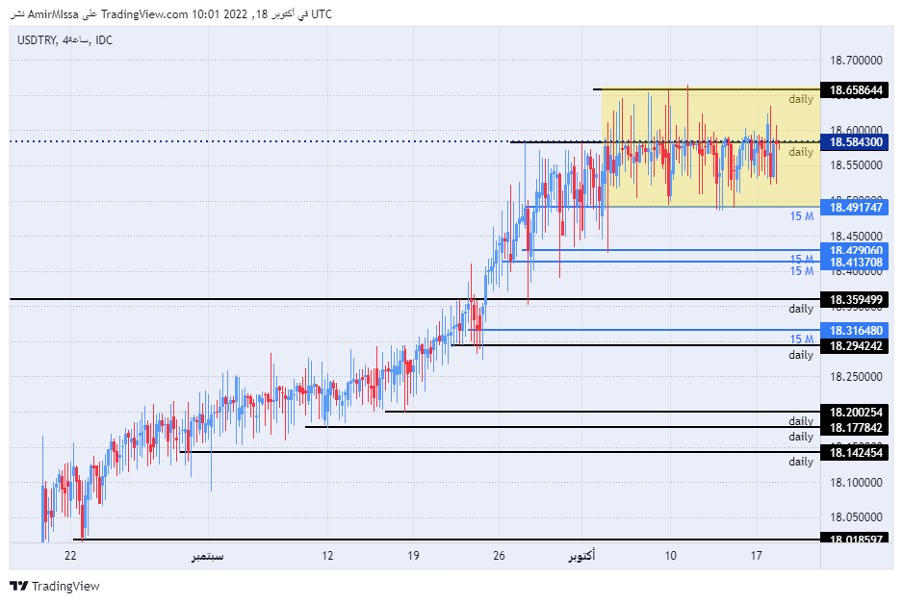

On the technical front, the Turkish lira recorded slight changes against the dollar. Where the pair is trading within a narrow trading range near the record low at 18.66 levels, which was recorded during the current month. The pair is trading the highest levels of support, which are concentrated at levels of 18.50 and 18.40, respectively. On the other hand, the lira is trading below the resistance levels at 18.65 and 18.99, respectively. In the meantime, the pair is trading above the 50, 100 and 200 moving averages on the daily time frame, indicating the general bullish trend, while the pair is trading between these averages on the four-hour time frame. Also, on the 60-minute time frame, which shows the extent of volatility and trading in the narrow range that the pair is recording. Any drop for the pair represents an opportunity to buy back again with the aim of reaching the previous high recorded during the past year. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our free Forex currency signals? Here are some excellent Forex brokers to choose from.

Ready to trade our free Forex currency signals? Here are some excellent Forex brokers to choose from.

[ad_2]